Stocks With Good Dividends: Best Monthly, Growth & Buy-and-Hold Picks for 2026

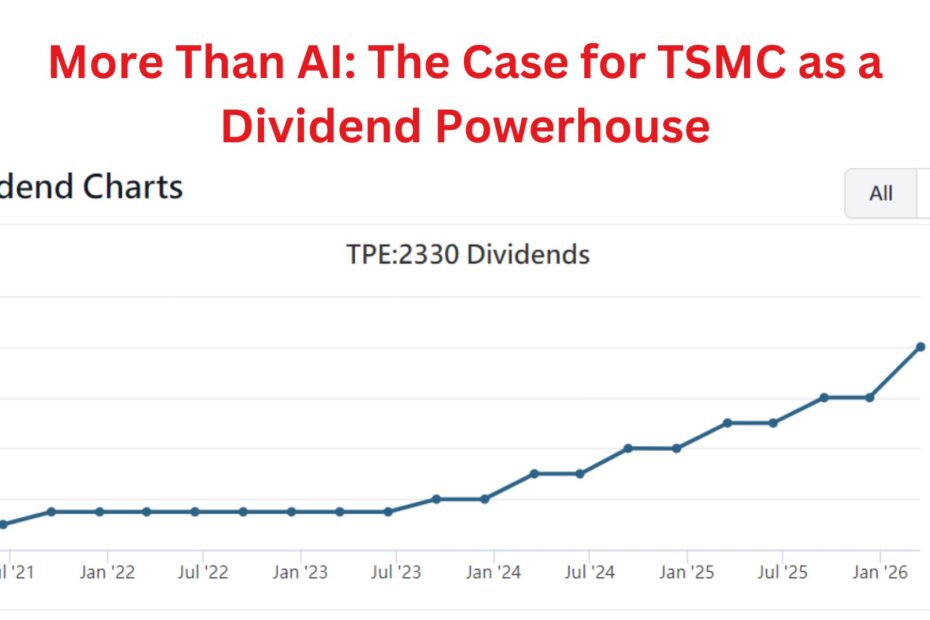

Building a reliable passive income stream in 2026 requires more than just chasing the highest yields. This guide explores the framework for identifying “stocks with good dividends” by focusing on cash flow durability, payout safety, and consistent growth. From the “gold standard” of dividend ETFs like SCHD to high-growth powerhouses like TSM, learn how to filter for undervalued opportunities and avoid common yield traps using professional-grade screening strategies.