Table of Contents

- 1 Performance Comparison Graph of 4 Types of Long-term Investment Strategy

- 2 An Introduction to the Four Major Long-Term Investment Strategies

- 3 Performance Ranking of the Four Major Long-Term Investment Strategies Over the Past 10 Years, Measured by Geometric Average Annual Return

- 4 Personal Performance Summary from 3 Years of Implementing Focused Investing

- 5 Focus Investing

- 5.1 Representative of Focused Investing: Warren Buffett

- 5.2 Finding Exceptional Companies

- 5.3 Tenets of the Warren Buffett Way

- 5.4 How Focused Investing Reduces Risk

- 5.5 Less Is More: Hold No More Than 15 Stocks

- 5.6 Betting Big on High-Probability Events

- 5.7 Patience is Key

- 5.8 Don’t Panic Over Price Fluctuations

- 5.9 The Three Key Steps to Focused Investing

- 6 Market-Cap ETFs

- 7 High-Dividend ETFs

- 8 Bond ETFs

- 9 Related Articles

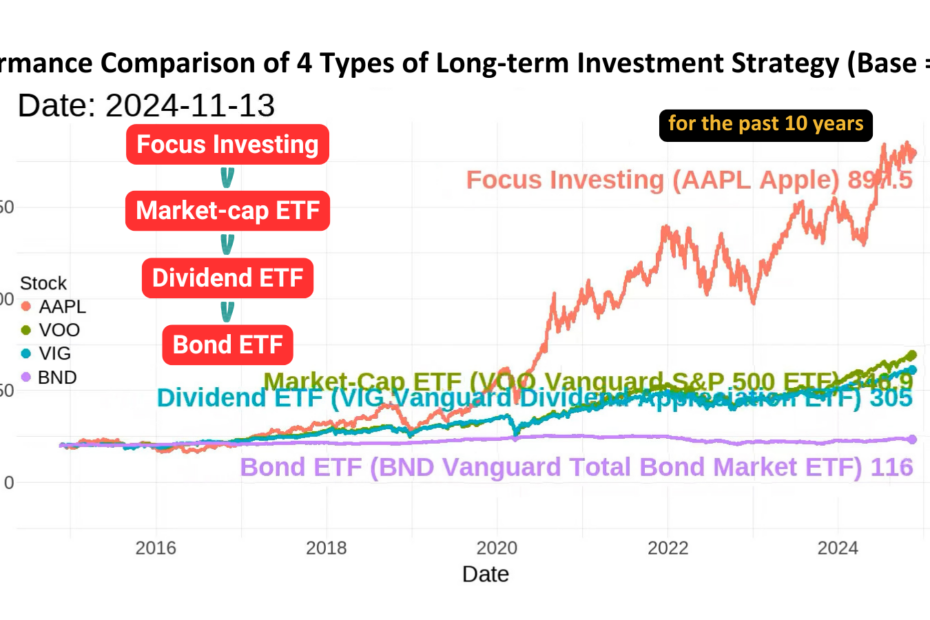

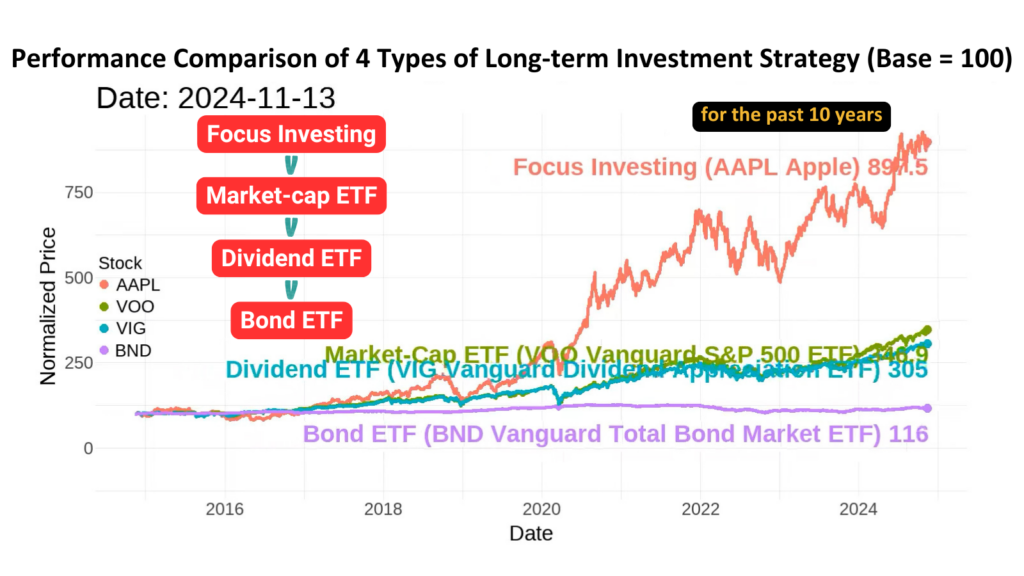

Performance Comparison Graph of 4 Types of Long-term Investment Strategy

Excluding short-term speculation akin to gambling, our research today focuses on a 10-year long-term investment perspective. We found that the performance of focus investing outperforms market-cap-weighted ETFs, which in turn outperform high-dividend ETFs, and these perform better than bond ETFs.

Assuming an investor allocated $100 thousand to each of these four strategies 10 years ago, the results are as follows:

– Focus investing is represented by Apple (stock code: AAPL),

– Market-cap-weighted ETFs by Vanguard S&P 500 ETF (VOO),

– High-dividend ETFs by Vanguard Dividend Appreciation ETF (VIG),

– Bond ETFs by Vanguard Total Bond Market ETF (BND).

After 10 years, the final values of these investments are $884 thousand, $342 thousand, $302 thousand, and $116 thousand, respectively.

The animation illustrates the value changes of these four long-term strategies, all starting with an initial value of $100 thousand. Over time, their performance diverges significantly.

The prices used here are adjusted prices, which include total return performance — meaning they account for dividends received.

The intriguing questions are:

– Why does an focus investing strategy, such as investing in Apple, generate such extraordinary returns of $884 thousand from an initial investment of $100 thousand?

– Why does a conservative bond ETF, like Vanguard Total Bond Market ETF, result in a small gain, with the final value increasing to just $116 thousand from $100 thousand?

How can investors select the most suitable investment strategy based on their risk tolerance and personal preferences, achieving the best possible returns while still enjoying peaceful sleep every night?

Below, we will introduce each strategy in detail and provide an in-depth analysis of their respective strengths and weaknesses.

An Introduction to the Four Major Long-Term Investment Strategies

Focus Investing (Example: AAPL – Apple)

Focus investing focuses on investing in the shares of specific companies. Investors aim to achieve long-term returns by analyzing and purchasing stocks of companies they believe will appreciate in value. This approach emphasizes in-depth analysis of a company’s fundamentals, such as its financial health, management, competitive advantages, and industry outlook, to assess its growth potential.

Warren Buffett, often referred to as the “Oracle of Omaha,” is a prominent figure in focus investing. He employs a value investing strategy, seeking companies whose market price is below their intrinsic value and holding these investments long-term to benefit from compounding returns. Buffett’s philosophy stresses patience and trust in high-quality companies, avoiding frequent buying and selling due to market fluctuations. Notable examples of his investments include Coca-Cola and See’s Candies, both of which possess stable business models and enduring competitive advantages, yielding substantial returns over time.

Market-Cap-Weighted ETF (Example: VOO – Vanguard S&P 500 ETF)

Market-cap-weighted ETFs (Exchange-Traded Funds) are investment tools that track market indices, such as the S&P 500 or the Taiwan Weighted Index. These ETFs allocate their holdings based on the market capitalization of constituent companies, enabling investors to achieve the performance of a broad market through a single investment product.

The main advantage of market-cap-weighted ETFs lies in risk diversification, as they typically hold shares of numerous large companies, reducing reliance on the performance of any single stock. This approach is ideal for investors seeking to participate in overall market growth with relatively lower risk. Additionally, market-cap-weighted ETFs are cost-effective and easy to manage, making them a cornerstone of passive investing. Investors can simply hold the ETF to benefit from the long-term growth of the market without spending significant time on stock selection.

High-Dividend ETF (Example: VIG – Vanguard Dividend Appreciation ETF)

High-dividend ETFs focus on holding stocks of companies with high dividend yields, selecting constituents that regularly distribute substantial dividends. The primary goal of this investment strategy is to provide investors with stable cash flow along with potential capital appreciation. These ETFs typically include large, stable companies with healthy financials and consistent dividend payments.

High-dividend ETFs are particularly attractive to income-focused investors seeking passive income. Compared to selecting individual dividend stocks, these ETFs allow investors to own shares of multiple companies, spreading risk and stabilizing returns. Furthermore, their relatively lower volatility makes them suitable for long-term holdings, often serving as a part of retirement or income-focused portfolios.

Bond ETF (Example: BND – Vanguard Total Bond Market ETF)

Bond ETFs are funds that invest in the bond market, tracking the performance of government bonds, corporate bonds, or other fixed-income assets. The primary objective of this investment strategy is to provide a steady income source with lower volatility compared to stock investments. Bond ETFs typically exhibit less price fluctuation, with returns primarily derived from interest payments, making them ideal for risk-averse investors seeking stable returns.

Key benefits of bond ETFs include high liquidity (easier to buy and sell compared to individual bonds) and diversified risk through holdings in a range of bonds. They are a convenient and cost-effective choice for investors looking to diversify their portfolios, balance risk, and achieve fixed income returns.

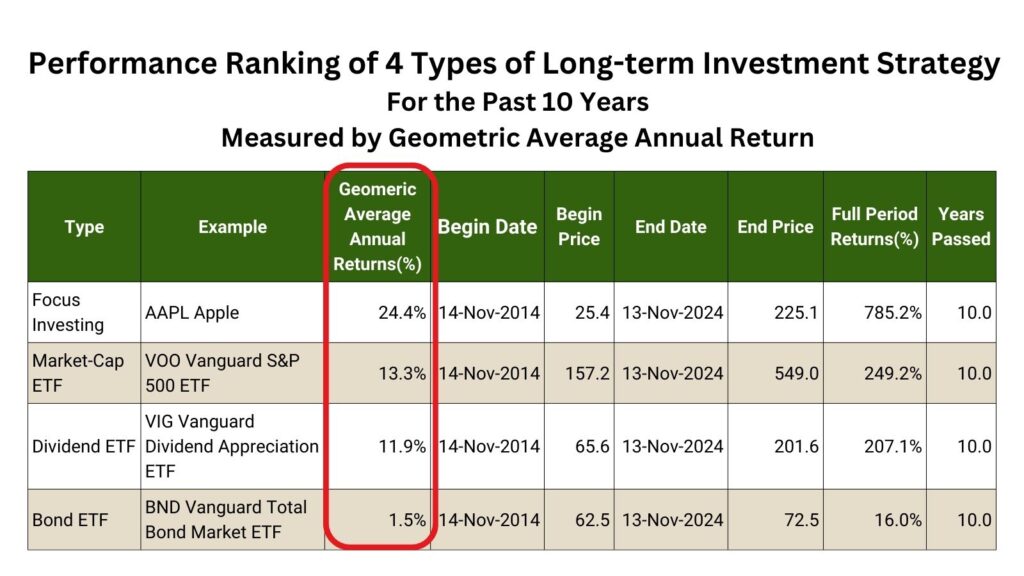

Performance Ranking of the Four Major Long-Term Investment Strategies Over the Past 10 Years, Measured by Geometric Average Annual Return

We compared these four long-term investment strategies over a 10-year holding period and evaluated the average annual return for each strategy by calculating the geometric average annual return.

The Geometric Average Annual Return is a measure of an investment’s long-term growth rate, representing the average annual return over a specific period. Unlike the arithmetic average, the geometric average accounts for the effect of compounding, making it a more accurate reflection of the actual growth rate, especially when there are significant fluctuations in returns.

To calculate the geometric average annual return, you multiply the annual returns for each year, take the n-th root (where n is the number of years), and subtract 1. This method incorporates the impact of yearly fluctuations, which is why the geometric average annual return is usually lower than the arithmetic average. It is particularly suitable for evaluating the performance of long-term investments.

As shown in the table, ranked by geometric average annual return:

– First place is focus investing at 24.4%,

– Second is market-cap ETFs at 13.3%,

– Third is dividend ETFs at 11.9%,

– Last is bond ETFs at 1.5%.

Welcome to Sunfortzone, our goal is to help value investors understand more about their investments and become a better person.

If you want to grow on the path of value investing, please subscribe to our Youtube channel to get more valuable contents in the future.

Wall streets make money on activities, we, as value investors, make money on inactivities.

Personal Performance Summary from 3 Years of Implementing Focused Investing

I personally believe in focus investing and the power of focus, rather than spreading investments thinly across numerous stocks. Here, I’d like to share my experience investing in U.S. stocks between 2021 and 2022. My portfolio included companies like NVIDIA, Facebook, and Google—businesses I am familiar with and confident in.

To start, I added companies I understood and believed in to my value investing group. I spent time regularly reading their financial reports, following relevant fundamental news, and strategically buying during bearish market conditions to secure good prices. Over three years of applying value investing principles, I’ve seen significant returns. For example, my cost basis for NVIDIA was $20 per share, and its current market price is $142, reflecting an unrealized gain of 587%. This performance has significantly outpaced the broader market. In fact, all eight companies I invested in have been profitable, and I’m holding onto them tightly without selling easily.

Right now, the market feels overheated, so I haven’t purchased any stocks since October 2022. I just let my cash piles up. However, if the market cools down in the future and the fundamentals of these companies remain solid, I will undoubtedly buy more during a major market downturn.

I hope my success story inspires others to adopt this value-investing approach of buying and holding great companies for long-term gains. When you invest in a quality company, it’s like getting a two-for-one deal: you’re not only buying a great business but also gaining access to skilled management teams working to grow the company. It’s an excellent example of putting your money to work for you.

Focus Investing

Representative of Focused Investing: Warren Buffett

Warren Buffett, often considered the epitome of focused investing, once stated,

“We only focus on a few outstanding companies. We are focused investors.”

The Concept of Focused Investing

Focused investing is an exceptionally simple concept. However, like many simple ideas, it rests on a foundation of complex, interwoven principles. When we examine this approach closely, we find that beneath its apparent clarity lies depth, substance, and solid reasoning.

At its core, focused investing can be summarized as:

- Identifying a few stocks with the potential to deliver above-average returns over the long term.

- Concentrating the majority of investments in these stocks.

- Demonstrating the resilience to hold steady and not sell during short-term market volatility.

Finding Exceptional Companies

Over the years, Warren Buffett developed a method for selecting companies worth investing in, rooted in common sense:

If a company is fundamentally sound and managed by intelligent people, its intrinsic value will eventually be reflected in its stock price.

As a result, Buffett focuses his efforts on analyzing the economic characteristics of businesses and assessing their management teams, rather than merely tracking stock prices.

This does not imply that evaluating a company’s fundamentals or uncovering information to reveal its economic value is an easy task. It requires effort. But as Buffett often notes, the energy spent on this “homework” is less exhausting than constantly monitoring the market, and it yields far more valuable results.

Buffett’s analytical process involves comparing each investment opportunity against a set of principles or basic criteria. These guidelines, detailed in The Warren Buffett Way, are summarized below. They can be seen as a toolkit, where each individual principle serves as an analytical tool. Together, they provide a method for identifying companies most likely to deliver strong economic returns.

Tenets of the Warren Buffett Way

Business Tenets

- Is the business simple and understandable?

- Does the business have a consistent operating history?

- Does the business have favorable long-term prospects?

Management Tenets

- Is management rational?

- Is management candid with its shareholders?

- Does management resist the institutional imperative?

Financial Tenets

- Focus on return on equity, not earnings per share.

- Calculate “owner earnings.”

- Look for companies with high profit margins.

- For every dollar retained, make sure the company has created at least one dollar of market value.

Market Tenets

- What is the value of the business?

- Can the business be purchased at a significant discount to its

value?

By adhering to these principles, Buffett identifies and invests in companies that are not only economically sound but also likely to provide superior returns over time.

Strictly Following Warren Buffett’s Principles

By adhering strictly to Warren Buffett’s principles, you are bound to find great companies suitable for a focused investment portfolio. This is because you will be selecting companies with strong historical performance and stable management—attributes that often indicate the potential for continued excellence in the future. This approach embodies the essence of focused investing: concentrating capital on companies with the highest probability of outperforming the market.

The Logic Behind Focused Investing: Probability Theory

One of the underlying logics of focused investing stems from probability theory in mathematics. Think of “great companies” as “high-probability events” and practice this mental exercise frequently. Through analysis, you identify companies with solid track records and promising prospects. Now, consider these companies from a new perspective—through the lens of probability.

How Focused Investing Reduces Risk

“Our stock investment strategy rejects the standard dogma of broad diversification,” Buffett has said. “Many critics might argue this approach is riskier than the traditional strategies adopted by most investors. However, we believe that if a concentrated investment strategy enhances the investor’s depth of thought about the business and instills confidence in its economic characteristics before purchase, it may actually reduce risk.”

In essence, by deliberately focusing on a few companies, you can research them more thoroughly and understand their intrinsic value better. The more you know about a company, the less risk you typically bear.

Less Is More: Hold No More Than 15 Stocks

Buffett famously advised novice investors to invest in index funds. However, his more interesting comment is directed toward those with a basic understanding of investing:

“If you’re a bit knowledgeable and can understand business economics, you’ll likely find five to ten companies with significant long-term competitive advantages and reasonable prices. In such cases, traditional diversification—meaning a broad, actively managed portfolio—becomes irrelevant to you.”

What’s the problem with broad diversification? For one, it significantly increases the chances of investing in businesses you don’t understand well. Investors with some knowledge, applying Buffett’s principles, are better served by focusing their attention on a handful of companies. Buffett recommends selecting five to ten companies. Others who practice focused investing advocate for even fewer, sometimes as few as three. For most investors, a reasonable range is between 10 and 15 companies.

The key is not the exact number but understanding the concept behind it. Applying focused investing to a portfolio with dozens of stocks dilutes its effectiveness.

Philip Fisher’s Influence

Philip Fisher, a pioneer in focused investing, deeply influenced Buffett. Known for his books “Common Stocks and Uncommon Profits” and “Paths to Wealth Through Common Stocks”, Fisher’s philosophy resonated with Buffett.

Fisher’s investment style revolved around holding a concentrated portfolio of exceptional companies he knew thoroughly. Having begun his investment advisory career after the 1929 stock market crash, Fisher emphasized the importance of thorough knowledge, recalling that “there was no room for error back then.” Generally, his portfolio held fewer than ten stocks, with three to four typically comprising 75% of the total investment.

Fisher once remarked, “Neither investors nor their advisors realize how dangerous it is to invest in companies they don’t understand well.”

Betting Big on High-Probability Events

Fisher’s influence also shaped Buffett’s belief that when a strong opportunity arises, the only reasonable action is to make a substantial investment. Like Fisher, Buffett values discipline and dedicates significant effort to understanding a business. When convinced, he invests heavily. Fisher’s son, Ken Fisher, highlighted his father’s approach: “He understood what having large positions in great opportunities meant.”

Buffett echoes this sentiment today:

“Each investment should give you the confidence to allocate at least 10% of your net assets to it.”

This principle explains why Buffett believes an ideal portfolio should contain no more than ten stocks, each comprising at least 10% of the portfolio. However, focused investing is not about evenly distributing capital across ten good stocks. Even among high-probability opportunities, some are stronger than others and warrant a greater allocation.

One striking example of this principle was Buffett’s 1963 investment in American Express during the “Salad Oil Scandal.” Following allegations of fraudulent warehouse receipts, American Express’s stock price plummeted from $65 to $35. Buffett saw this as an opportunity, investing $13 million—40% of his partnership’s assets—acquiring nearly 5% of American Express’s outstanding shares. Over the next two years, the stock tripled, earning Buffett’s partnership $20 million in profit.

This illustrates the courage and conviction required for successful focused investing: betting big on high-probability events.

Patience is Key

Focused investing stands in stark contrast to broad diversification and high-turnover strategies. Among active strategies, focused investing is most likely to outperform index returns in the long run, but it demands patience from investors even when other strategies are yielding better short-term results. While short-term factors like interest rate changes, inflation, or earnings expectations can influence stock prices, over time, the trajectory of a company’s underlying business becomes the primary determinant of its stock value.

How Long Should You Hold?

There is no strict rule for the ideal holding period, though Warren Buffett might argue that anything less than five years is unwise. The goal isn’t zero turnover—avoiding new opportunities can be counterproductive. A reasonable target holding period is about 5 to 10 years.

Don’t Panic Over Price Fluctuations

Focused investing aims for above-average results but often comes with a bumpy ride. Patience is essential, as focused investors rely on long-term returns and trust that strong fundamentals will eventually outweigh short-term volatility.

Strategies for Managing Emotions

1. Reframe Your Perspective: Treat stocks as ownership in real businesses, not just numbers on a screen. Ask yourself: Is the company still strong and poised for growth? If so, a short-term price drop might be an opportunity.

2. Focus on Fundamentals: Regularly check a company’s health—its earnings, competitive position, and management quality. Understanding a company’s intrinsic value can help you stay calm during market fluctuations.

3. Maintain a Margin of Safety: Following Buffett’s advice, buy at a price well below intrinsic value to provide a cushion during market downturns.

4. Limit Market Checks: Constantly watching stock prices can amplify stress. Limit how often you check prices—perhaps quarterly—to avoid overreacting to short-term moves.

5. Build Emotional Resilience: Over time, experience strengthens your ability to weather market downturns. Reviewing historical recoveries can remind you that declines are usually temporary and that markets tend to grow steadily in the long run.

The Three Key Steps to Focused Investing

To summarize, the process of focused investing involves the following steps:

1. Select Great Companies: Use Warren Buffett’s principles to identify a few (10–15) outstanding companies with a strong track record and a high probability of sustained success.

2. Invest at the Right Price: Purchase shares when their prices are undervalued relative to their intrinsic worth. Allocate your funds proportionately, putting the most capital into the opportunities with the highest likelihood of success.

3. Hold Steadily: Keep your portfolio largely unchanged for at least five years (longer if possible), as long as the fundamentals remain strong. Learn to stay calm amid price volatility.

Market-Cap ETFs

Active vs. Passive Funds

In today’s investment landscape, portfolio management often revolves around a tug-of-war between two competing strategies: active funds and index investing, also known as passive funds or market-cap ETFs.

Active Funds

Active fund managers frequently buy and sell large numbers of stocks, aiming to satisfy their clients by consistently outperforming the market. Clients often measure success with the question: “How is my portfolio performing compared to the overall market?” A positive answer keeps clients invested. To stay ahead, active managers attempt to predict stock market trends for the next six months or shorter timeframe and constantly adjust portfolios in pursuit of gains.

Today, the average mutual fund holds over 100 stocks and has a turnover rate of 80%.

Passive Funds

In contrast, index investing is a “buy and hold” passive strategy. It involves building and maintaining a diversified stock portfolio designed to mimic the performance of a specific benchmark index, such as the S&P 500.

Performance Comparison: Active vs. Passive Funds

Recent data suggests that passive funds generally outperform active funds over the long term, particularly in large-cap U.S. stocks. According to S&P’s latest report, about 60% of U.S. large-cap active funds underperformed the S&P 500 in 2023. Over the past decade, 96% of these funds lagged behind the index.

Active portfolio management often struggles to outperform the S&P 500 because institutional managers, who collectively buy and sell hundreds of stocks annually, essentially are the market. Their approach hinges on predicting short-term gains from today’s purchases—a flawed logic given the inherent complexity of financial markets. High costs associated with active management further reduce net returns for investors, often undermining the strategy itself.

In contrast, index investing avoids these costs and offers a straightforward way to match market performance. While it won’t outperform the market, it also won’t underperform.

Diversification: A Common Ground for Both Strategies

Both active and passive strategies share the same primary appeal: risk reduction through diversification. By holding a wide array of stocks across industries and sectors, investors aim to mitigate significant losses in case of downturns in specific markets. Typically, some stocks in a diversified portfolio will decline while others rise, with the hope that gains will offset losses.

Active managers argue that increasing the number of stocks in a portfolio improves diversification—ten stocks are better than one, and one hundred stocks are better than ten. Index funds, provided they replicate diversified benchmarks, achieve similar risk-spreading effects. Traditional mutual funds, with their hundreds of constantly changing holdings, also offer diversification.

The Downside of Diversification: Mediocre Results

We’ve long heard the mantra of diversification, so much so that its inevitable outcome—mediocre results—is often overlooked. While both active and index funds effectively spread risk, they rarely deliver exceptional returns. Savvy investors should ask themselves: “Am I satisfied with average returns? Can I do better?”

Index Investing: Consistently Outperforming Professionals

The ongoing debate between index investing and active strategies has a clear advocate in Warren Buffett, who unreservedly favors index investing. For investors with limited risk tolerance and minimal understanding of business economics but who still want long-term stock market exposure, Buffett considers index funds the best choice.

In his signature style, Buffett explains:

“By regularly investing in index funds, the know-nothing investor can actually outperform most investment professionals.”

Market-Cap ETFs: Suitable for Beginners

Market-cap ETFs are ideal for those with little investment knowledge. While they match market performance, they cannot outperform it. Buffett emphasizes:

“A diversified investment strategy protects you from the dangers of ignorance. If you want to ensure nothing bad happens relative to the market, you should own everything. For those who don’t know how to analyze businesses, this approach is entirely reasonable.”

However, Buffett points out that diversification has its cost: mediocrity. He adds:

“Diversification teaches you how to achieve average results, something almost anyone can learn by fifth grade.”

The Third Option: Focused Investing

Buffett advocates for a third option—a distinct, active strategy that significantly increases the likelihood of outperforming the index: concentrated individual stock investing.

High-Dividend ETFs

A Preference for Steady Cash Flow

The appeal of stable cash flow is one of the main reasons investors are drawn to high-dividend ETFs. These ETFs provide consistent income through dividends, making them especially attractive to individuals seeking steady cash flows, such as retirees or those looking to supplement their income.

Predictable Payouts

Many high-dividend ETFs distribute dividends quarterly, and some even pay them monthly in the Taiwan market, creating a predictable income stream for investors.

Lower Volatility and Risk

Defensive Stocks: High-dividend ETFs often invest in mature, financially stable companies—such as utilities, consumer staples, and telecommunications—that are known for steady performance and lower volatility. These characteristics provide a degree of protection during market downturns.

Reduced Volatility: Dividend-paying companies typically exhibit lower volatility, making high-dividend ETFs an ideal choice for conservative investors.

High Dividends Don’t Always Mean High Returns

Because high-dividend ETFs primarily invest in mature companies that consistently distribute dividends, these companies tend to have lower growth potential. Lower risk often comes with lower returns, meaning the overall performance of high-dividend ETFs may lag behind market-cap ETFs.

High-growth companies, on the other hand, often reinvest earnings into capital expenditures to meet unmet market demands rather than paying dividends. Management chooses to retain earnings for higher-return reinvestments, ultimately driving greater long-term net profits and stock price appreciation. This approach explains why companies like Warren Buffett’s Berkshire Hathaway have avoided paying dividends for over 50 years. Buffett believes Berkshire can generate greater shareholder value by reinvesting earnings into acquiring great businesses rather than distributing them as dividends. Investors needing cash can create their own “dividends” by selling a portion of their stock holdings.

Conversely, if a company lacks opportunities to reinvest earnings—such as funding research, expanding operations, or developing new markets and products—it makes sense to return profits to shareholders as dividends. However, this often signals a company that has reached a growth plateau. In a competitive market, standing still often equates to falling behind, which explains why high-dividend ETFs typically underperform market-cap ETFs in total returns.

The Risk of Losing Capital Gains

While high-dividend ETFs provide stable dividend income, they come with the risk of earning dividends but losing capital value. These ETFs often invest in sectors like finance, utilities, energy, and telecommunications, which offer high dividends but lower growth. If the companies within the ETF face operational challenges, declining revenues, or poor fundamentals, their intrinsic value may decrease. This can result in reduced or suspended dividends. When both share prices and dividends fall, investors may face significant losses.

Bond ETFs

Bonds, compared to stocks, are not ideal for long-term investments for several reasons:

Lower Long-Term Returns with Limited Fixed Income

Stocks, especially those of high-quality companies, can provide significantly higher returns. While stock prices may fluctuate, the long-term trend for quality companies is growth in earnings, which drives stock prices upward. Bonds, on the other hand, generally offer fixed returns (e.g., fixed interest rates). These returns remain unchanged even as market conditions evolve, limiting their potential compared to the variable and often growing returns of stocks.

Inflation Risk

Bonds perform poorly in an inflationary environment because their returns are fixed. Inflation erodes the real value of bond returns, particularly for long-term bonds. If inflation exceeds the bond’s interest rate, investors face a real loss in value. Stocks, however, are better equipped to combat inflation over the long term since businesses can adjust prices to offset rising costs.

Interest Rate Risk

When interest rates rise, the value of existing bonds declines because new bonds offer higher yields, making older bonds less attractive. For long-term bondholders, this means bond prices can fluctuate, and unlike stocks, bonds do not benefit from long-term value appreciation.

Equity Growth Advantage

We advocate for long-term investment in high-quality stocks because companies reinvest their profits to drive growth. This growth is often reflected in shareholder returns. Stocks represent “ownership” and participation in a company’s value creation, whereas bonds represent “debt” and merely entitle the holder to fixed repayments, offering no stake in the company’s growth.

Conclusion

Overall, we favor stocks for their potential to deliver higher returns, better inflation protection, and opportunities to participate in company growth. In comparison, bonds are a more conservative choice, particularly for investors seeking high returns in a long-term investment horizon.

Thanks for spending your valuable time with us! If you like our content, please like and subscribe to our Youtube channel to get more valuable content.

Furthermore, please visit our website sunfortzone.com for more data-driven insights, and join our Discord Server to discuss with other investors.

If you’ve learned something from our productions, please click the inclusive link down below to open an Interactive Brokers account for free. Your actions means a world to us!

When you open an account through the referral link above, you will receive 1 IBKR stock worth $1 USD for every $100 deposited, with a maximum value of $1,000 in IBKR stocks.

What’s your idea? please leave a comment below! We would like to learn something from you as well!

Related Articles

23 Key Takeaways from Poor Charlie’s Almanack

From Broke to Wealthy: 17 Powerful Mindset Shifts That Transformed My Life