Table of Contents

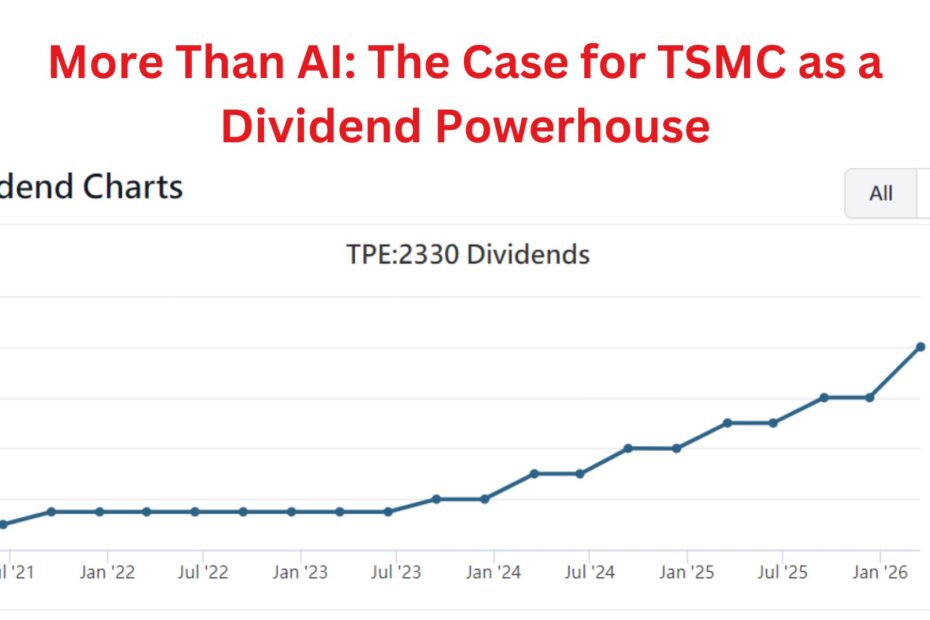

While TSMC (2330.TW / TSM) is world-renowned for its technological dominance in the AI and semiconductor space, it has quietly evolved into a powerhouse for dividend growth.

Investors often overlook its yield because the stock price has risen so rapidly, but the underlying dividend metrics tell a story of consistent, aggressive growth backed by an ironclad balance sheet.

1. The “Steadily Increasing” Policy

TSMC’s board has a formal commitment to a sustainable dividend policy. Their goal is to distribute a cash dividend each year/quarter at a level not lower than the year/quarter before. This creates a “ratchet effect” where the dividend only stays flat or moves up, providing a reliable floor for long-term holders.

2. Aggressive Dividend Growth CAGR

The growth rate of TSMC’s payout is actually higher than many traditional “Dividend Aristocrats.”

-

5-Year Growth: As of early 2026, the dividend has grown by over 120% over the last five years.

-

Recent Hikes: In late 2025 and early 2026, TSMC announced significant quarterly increases, moving from NT$4.50 to **NT$6.00 per share** (a 33% jump in a short period).

-

Consistency: The company shifted from annual to quarterly payments in 2019, allowing for more frequent compounding and signaling management’s confidence in steady cash flow.

3. High Safety (The Payout Ratio)

One of the strongest indicators of a “strong” dividend growth stock is how much of the profit is left over after paying shareholders.

-

Payout Ratio: TSMC typically maintains a payout ratio of roughly 23–30%.

-

Why this matters: Most dividend-heavy companies pay out 50–70% of earnings. TSMC’s low ratio means the dividend is incredibly safe, even if the semiconductor cycle takes a temporary dip. It also means they have massive “dry powder” to continue hiking the dividend while still spending $50B+ on Capex to build new plants in Arizona and Taiwan.

| Year | Total Annual Dividend (NT$) | Key Note |

| 2021 | 11.00 | Post-pandemic demand surge |

| 2023 | 13.00 | Shift toward AI-driven growth |

| 2025 | 19.00 | Massive 20%+ increase year-over-year |

| 2026 (Est.) | 24.00+ | Based on current NT$6.00/quarter trajectory |

4. The “Yield on Cost” Factor

Because the stock price has appreciated so much (hitting record highs in 2024 and 2025), the current yield often looks small (around 1%). However, for long-term investors, the yield on cost is the real prize.

Example: An investor who bought 2330 at NT$500 a few years ago and is now receiving NT$24 per year in dividends is enjoying a 4.8% yield on their original investment—a yield that continues to grow every year.

The Bottom Line

TSMC is a rare “double threat.” You get the growth of a high-tech AI leader and the security of a cash-rich utility. It is a textbook example of a dividend growth stock because its “moat” (70%+ market share in advanced nodes) ensures the cash flow required to keep those checks growing for years to come.