Table of Contents

- 1 Introduction

- 2 The Power of Monthly Dividend Stocks for Reliable Income

- 3 Building Passive Income with the Best Dividend ETF’s

- 4 Compounding Wealth: Best Dividend Stocks to Buy and Hold

- 5 How to Find the Best Dividend Stocks in 2026

- 6 Dividend Growth Stocks

- 7 Common Dividend Investing Mistakes

- 8 Conclusion

- 9 Related Articles

Introduction

We invest for the same reason: to build durable income that compounds over time without sacrificing peace of mind. If you have ever felt tempted by a double-digit yield, only to later question its sustainability, you are not alone. Most income investors learn this lesson the hard way.

At Sunfortzone, we believe stocks with good dividends are not defined by how high the yield looks today, but by how reliably that income can be sustained and grown across cycles. Finding the best dividend stocks requires looking beyond the surface level to find businesses that can survive economic shifts.

If you agree that long-term reliability matters more than short-term excitement, this framework will resonate with you.

The Power of Monthly Dividend Stocks for Reliable Income

Monthly dividend stocks appeal to investors who value predictable cash flow. Receiving income every month can reduce reinvestment friction and improve budgeting discipline. However, frequency alone does not equal quality. A weak business paying monthly dividends is still a weak business.

What Actually Matters in Monthly Dividend Stocks

When searching for the best monthly dividend stocks, three factors matter most:

- Cash flow consistency

- Conservative payout structures

- Downside protection during market stress

The safest monthly dividend stocks prioritize these fundamentals over high-risk engineering. Monthly payers that fail on these dimensions often compensate investors with yield — until they cannot.

Welcome to Sunfortzone, our goal is to help value investors understand more about their investments and push them towards financial freedom.

If you want to grow on the path of value investing, please subscribe to our Youtube channel to get more valuable contents in the future.

Wall streets make money on activities, we, as value investors, make money on inactivities.

Top 10 Picks for Monthly Dividend ETFs

The following monthly dividend etf list highlights popular funds, showing yield, dividend growth, payout ratios, and distribution timing. These are often viewed as the best monthly dividend funds for those seeking diversified exposure.

Several patterns stand out. First, yields vary dramatically. Some funds offer mid-single-digit yields, while others are considered the highest paying monthly dividend stocks (or funds) with yields exceeding 10%. This range reflects very different risk profiles. Second, payout ratios are often elevated, signaling that income stability depends heavily on market conditions. Third, dividend growth is uneven; some funds deliver attractive income today but limited growth potential tomorrow.

CEO perspective: While a monthly dividend stocks list can be a great starting point, these should be treated as income tools, not compounding engines. Position sizing and diversification matter more here than anywhere else.

Building Passive Income with the Best Dividend ETF’s

For many investors, searching for the best dividend etf’s represents the most practical starting point. They reduce single-stock risk, lower monitoring requirements, and help investors avoid emotional decision-making during volatility.

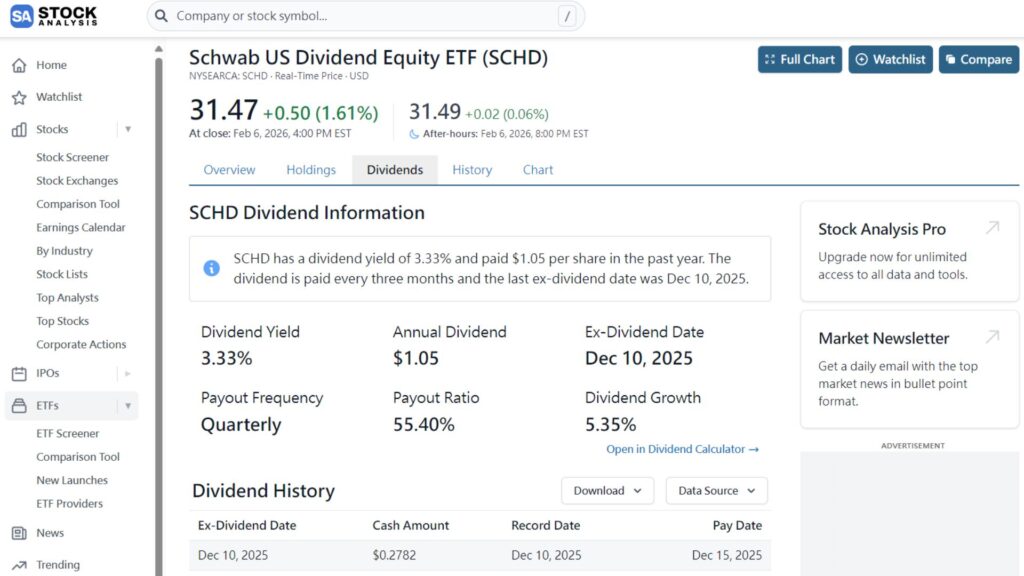

The Gold Standard: Schwab US Dividend Equity ETF (SCHD)

When looking for the absolute best dividend etf’s to anchor a portfolio, the Schwab US Dividend Equity ETF (SCHD) consistently earns its place as our top recommendation. SCHD is designed to track the Dow Jones U.S. Dividend 100™ Index, focusing on high-yielding stocks with a consistent track record of paying dividends and strong financial strength.

What makes SCHD stand out are its “good sides”:

- Strict Quality Filters: It screens for cash flow to total debt, return on equity, and dividend yield, ensuring it only holds high-quality businesses.

- Low Cost: With an ultra-low expense ratio of 0.06%, more of your returns stay in your pocket to compound.

- Balanced Growth and Yield: It offers a competitive starting yield combined with double-digit 10-year dividend growth, making it a premier choice for great dividend growth stocks.

How to Evaluate Dividend ETFs Properly

Dividend yield is only the first layer of analysis. We encourage investors to look deeper:

- Payout ratio: Indicates how much room the fund has to sustain distributions.

- Dividend growth: Separates income maintenance from income growth.

- Underlying holdings: Determines resilience during downturns.

A moderate yield with strong sustainability often outperforms a high yield with fragile foundations.

Why Institutions Favor Dividend ETFs

Institutional income portfolios rarely chase the highest yield available. Instead, they blend:

- Core dividend ETFs for stability.

- Select income-oriented funds for cash flow.

- Growth-oriented dividend exposure for inflation protection.

This balance reflects experience, not conservatism.

Best Dividend ETFs | Top 10 Picks

Below is a structured review of dividend-focused ETFs, using the same analytical lens as the dividend stocks section. The goal here is not to label winners or losers, but to clarify how each ETF functions, what kind of cash-flow profile it offers, and which type of long-term investor it may suit.

JEPQ – Income-Optimized Nasdaq Exposure JEPQ combines large-cap Nasdaq exposure with an options overlay designed to generate income. Its double-digit dividend yield is attractive, but the elevated payout ratio signals that distributions are largely strategy-driven rather than organic earnings growth. This ETF may suit investors prioritizing high monthly income over capital appreciation, while accepting variability in distributions.

JEPI – Defensive Income with Equity Participation JEPI focuses on lower-volatility U.S. equities while using covered calls to enhance income. Its yield is lower than JEPQ’s, but dividend growth has been steadier. This structure often appeals to investors seeking income with smoother equity behavior, especially during uncertain market cycles.

GPIX – Income Through Systematic Options GPIX follows a similar income-enhancement approach using options strategies. The dividend yield is competitive, though growth has been more moderate. Rather than viewing this ETF as a growth vehicle, it is better framed as a cash-flow tool within a diversified income portfolio.

BTCI – High Yield, High Complexity BTCI stands out with an unusually high dividend yield. However, the absence of dividend growth data and the nature of its underlying strategy suggest elevated risk and distribution uncertainty. This ETF may only be suitable for investors who fully understand non-traditional income mechanisms and can tolerate volatility in payouts.

FLJH – Income with Exceptional Recent Growth FLJH shows extraordinary recent dividend growth, though such growth rates are unlikely to persist indefinitely. Its yield remains solid, and the payout ratio is elevated but not extreme. This ETF can be viewed as a transitional income play, where monitoring sustainability matters more than headline numbers.

IDVO – International Dividend Stability IDVO provides exposure to international dividend-paying companies. Its yield is lower than many peers in this list, but dividend growth has been consistent and the payout ratio remains comparatively restrained. This ETF may fit investors looking to diversify income sources geographically.

QQQI – Aggressive Income Strategy QQQI delivers high income through an aggressive options-based structure. While the yield is appealing, the very high payout ratio indicates reliance on strategy execution rather than underlying earnings. This ETF is best considered as a satellite holding, not a core income anchor.

SPYI – Broad Market Income Overlay SPYI applies an income overlay to a broad U.S. equity universe. The yield is strong, though dividend growth has been minimal. This ETF may serve investors who want market-wide exposure with enhanced income, while remaining aware that distributions may fluctuate.

GPIQ – Balanced Income Orientation GPIQ sits between aggressive income and defensive positioning. Its yield is attractive, and dividend growth has been modest. Rather than focusing on short-term yield, this ETF can be interpreted as a balanced income contributor within a diversified ETF allocation.

DNP – Traditional Utility-Focused Income DNP differs from others by emphasizing utility and infrastructure assets. Its yield is stable, payout ratio is relatively conservative, and shareholder yield remains positive. This ETF is often considered by investors seeking predictable income with lower volatility, even if growth potential is limited.

CEO Perspective Dividend ETFs are tools, not promises. Yield alone does not define quality; understanding how income is generated matters more than the percentage shown on a screen. If you already believe that sustainable cash flow supports long-term compounding, these ETFs offer different ways to express that philosophy—each with trade-offs worth respecting.

Compounding Wealth: Best Dividend Stocks to Buy and Hold

Individual dividend stocks to buy allow for higher conviction and, potentially, better long-term outcomes. However, identifying a true “buy and hold” candidate requires finding a company with a durable competitive advantage and a cash flow engine that is virtually impossible to replicate.

The Ultimate Buy-and-Hold Example: Taiwan Semiconductor (TSM)

While many stocks offer yield, few offer the combination of dominance and growth found in Taiwan Semiconductor Manufacturing (TSM). TSM is not just a technology stock; it is the backbone of the modern digital economy, and its financial performance makes it the quintessential buy-and-hold dividend pick for 2026.

Why TSM Stands Alone

A true buy-and-hold stock must demonstrate the ability to grow its cash returns to shareholders aggressively while simultaneously reinvesting in its own future. TSM’s recent performance is a masterclass in this balance:

- Explosive Income Growth: TSM has delivered a staggering 32.65% dividend growth, proving that it is not just maintaining its payout, but actively prioritizing shareholder returns.

- Earnings Power: This dividend is backed by a robust 53% EPS growth, ensuring that the payouts are funded by organic profit expansion rather than debt.

- The Cash Flow Engine: Most impressively, TSM’s Free Cash Flow has nearly tripled in the past five years, surging from approximately $10 billion USD (316.5 billion NTD) to nearly $30 billion USD (945.3 billion NTD).

This level of cash flow expansion provides TSM with a massive “moat,” allowing it to fund the massive capital expenditures required for advanced chip manufacturing while still rewarding patient shareholders. For investors seeking the best dividend stocks to buy and hold, TSM offers a rare mix of safety, growth, and indispensable global relevance.

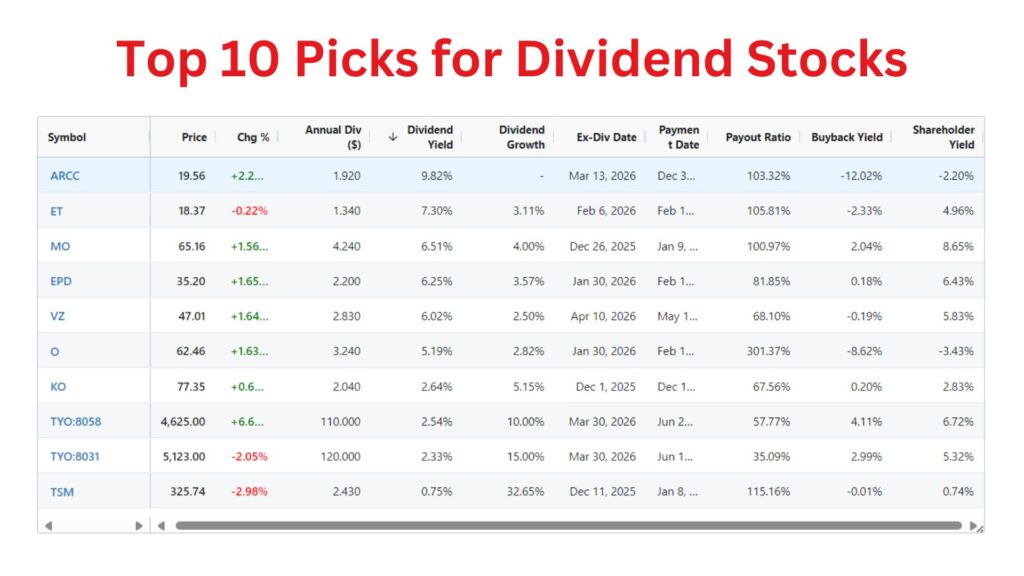

Top 10 Picks for Dividend Stocks

Below is a closer look at each dividend stock shown in the table, using the data as context rather than prediction. These examples illustrate how different dividend profiles serve different roles in an income portfolio.

ARCC (Ares Capital) The Ares Capital dividend yield is close to 9.8%, placing it firmly in the high-income category. The payout ratio is slightly above 100%, which means distributions rely heavily on portfolio performance and credit conditions. ARCC is often used as an income engine, not a low-risk anchor.

ET (Energy Transfer) With a dividend yield around 7.3% and a payout ratio just above 100%, ET offers attractive income backed by energy infrastructure cash flows. Dividend growth has been modest, highlighting stability over aggressive expansion. It is often cited as one of the great dividend stocks to buy now for those seeking midstream exposure.

MO (Altria Group) MO delivers a dividend yield of roughly 6.5%, supported by a long history of dividend payments. Dividend growth near 4% reflects a mature business model that prioritizes income consistency over growth. This consistency makes it a staple for those looking for high dividend undervalued stocks in traditional sectors.

EPD (Enterprise Products Partners) EPD shows a dividend yield around 6.2% with a payout ratio under 85%, suggesting better coverage than many high-yield peers. Its steady dividend growth points to disciplined capital allocation. This stability makes it one of the best dividend stocks to buy now for income coverage.

VZ (Verizon) Verizon’s dividend yield sits near 6.0%, with a payout ratio below 70%. Dividend growth is modest, but cash flow stability and scale make it a defensive choice for any best dividend stocks to buy list.

O (Realty Income) Often associated with monthly income, Realty Income offers a yield near 5.2%. The elevated payout ratio reflects its REIT structure, while steady dividend growth supports its reputation as an income-focused holding. It remains a core holding for those seeking reliable, frequent distributions.

KO (Coca-Cola) Coca-Cola’s dividend yield is lower at about 2.6%, but dividend growth of roughly 5% highlights quality over yield. This profile suits investors prioritizing durability and inflation protection.

TYO:8058 This Japan-listed name offers a dividend yield near 2.5% with dividend growth around 10%. The relatively low payout ratio suggests room for continued increases, appealing to growth-oriented income investors.

TYO:8031 With a dividend yield near 2.3% and dividend growth around 15%, this stock emphasizes growth over immediate income. The low payout ratio reflects reinvestment capacity.

TSM (Taiwan Semiconductor Manufacturing) TSM’s dividend yield is modest at approximately 0.8%, but dividend growth above 30% underscores strong cash flow expansion. This is a dividend growth story rather than an income stock.

CEO perspective: These examples show that dividend investing is not about finding a single “best” stock. Each dividend profile serves a different role, from high current income to long-term dividend growth. Cash flow strength remains the common denominator.

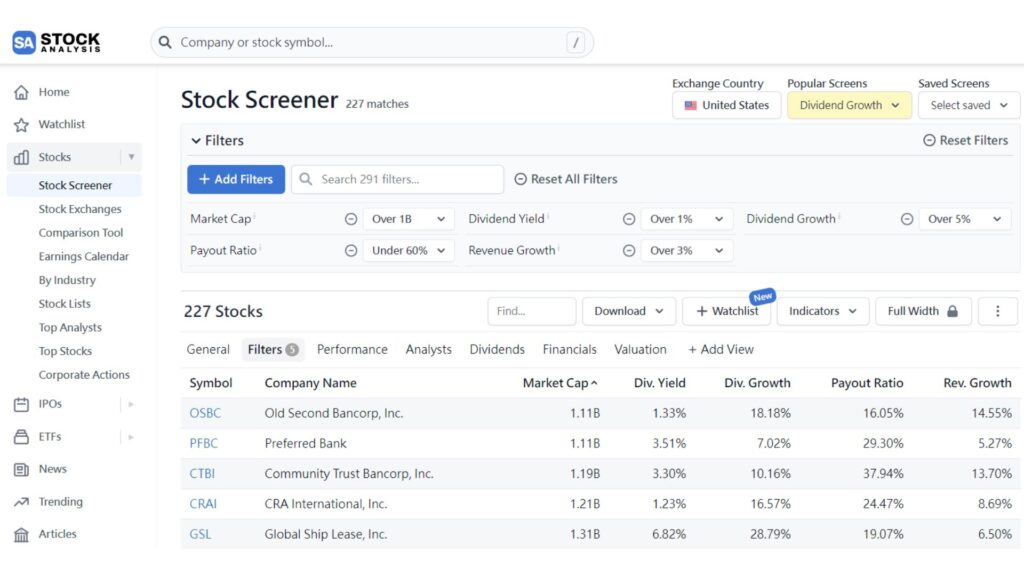

How to Find the Best Dividend Stocks in 2026

Identifying the best dividend stocks 2026 is not about guessing; it is about filtering out the noise. Like you, we prefer a disciplined, systematic approach to finding value rather than relying on luck or hype.

We all want to own best dividend stocks to buy and hold that offer both safety and growth. This is why we use a strict screening process to separate high-quality businesses from yield traps that look good on paper but fail in practice.

To uncover high dividend undervalued stocks, we recommend using a specific set of criteria. This filter helps identify companies with the financial strength to sustain their payouts.

Here is the exact filter setup we use on the StockAnalysis screener:

- Market Cap: Over $1B (Ensures stability and liquidity)

- Dividend Yield: Over 1% (Paying us to wait)

- Dividend Growth: Over 5% (Beating inflation consistently)

- Payout Ratio: Under 60% (Safety margin for reinvestment)

- Revenue Growth: Over 3% (Proof of organic business demand)

This simple screen cuts through the market clutter effectively. It highlights companies that are growing, profitable, and committed to returning capital to shareholders responsibly.

If you are interested in running this screen yourself, StockAnalysis Pro is an excellent tool. It provides the depth of data needed to make these decisions with confidence.

For our readers, using the code sunfortzone gives you 10% off. It is a resource worth exploring if you are serious about building a resilient income portfolio.

Dividend Growth Stocks

Dividend growth stocks are the quiet driver of long-term income success. While high yield attracts attention, dividend growth protects purchasing power and compounds wealth over decades.

How We Evaluate Dividend Growth

Our evaluation of great dividend growth stocks focuses on three elements:

- Calculating dividend growth: We look at long-term rates across cycles rather than just the last year.

- Free cash flow expansion: Ensuring the business creates more cash than it pays out.

- High growth high dividend stocks: We look for the “sweet spot” where yield and growth intersect.

- Conservative payout ratios that leave room for reinvestment.

This approach favors durability over spectacle. We share this framework openly so readers can apply it independently, regardless of portfolio size.

Common Dividend Investing Mistakes

Even experienced investors fall into predictable traps:

- Chasing the highest visible yield.

- Ignoring payout sustainability.

- Overconcentrating in a single sector or structure.

Humility matters. Markets are complex, and certainty is always an illusion.

Conclusion

If you believe dividend income should last for decades rather than quarters, discipline must guide every decision. Stocks with good dividends are built on business quality, cash flow strength, and prudent capital allocation.

Opportunities for finding great dividend stocks to buy now do not disappear overnight, but they do not wait indefinitely. If you’re interested, you can explore Sunfortzone’s suggested dividend research tools StockAnalysis Pro and ongoing analysis to go deeper at your own pace.

Take Control of Your Dividend Strategy

Stop guessing and start screening with the same precision as the pros. StockAnalysis Pro offers the advanced filters, deep financial history, and real-time alerts you need to identify high-quality income opportunities before the rest of the market catches on.

Whether you are hunting for the next great dividend growth stock or building a rock-solid monthly income stream, StockAnalysis Pro provides the clarity needed to invest with confidence.

Ready to upgrade your research? Explore StockAnalysis Pro Today Use code sunfortzone at checkout to save 10% on your subscription.

Related Articles

The Secret Compounder: Why TSMC (2330) Is the Ultimate Dividend Growth Engine