Why Does Focus Investing Performs Better than Market-Cap ETF than High-Dividend ETF than Bond ETF | 10-Year Empirical Study | Long-term Investing

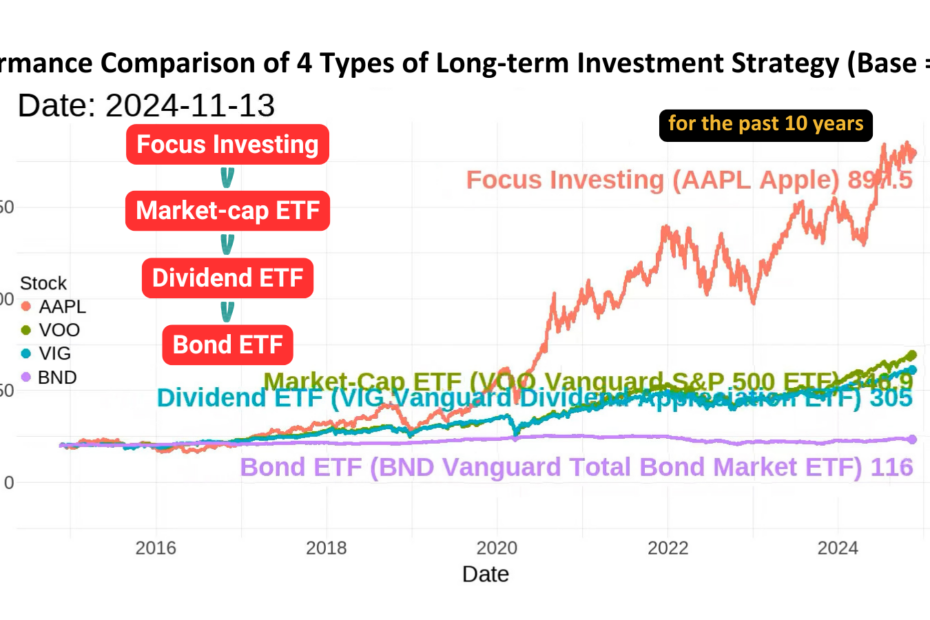

Excluding short-term speculation akin to gambling, our study today focuses on a 10-year long-term investment perspective. We found that individual stock investments (focus investing) outperform market-cap ETFs, market-cap ETFs outperform high-dividend ETFs, and high-dividend ETFs outperform bond ETFs.

Assuming an investor allocated $100,000 to each of these four strategies 10 years ago:

– focus investing (represented by Apple, AAPL) grew to $884,000.

– Market-cap ETF (represented by Vanguard S&P 500 ETF, VOO) grew to $342,000.

– High-dividend ETF (represented by Vanguard Dividend Appreciation ETF, VIG) grew to $302,000.

– Bond ETF (represented by Vanguard Total Bond Market ETF, BND) grew to $116,000.

How can investors choose a strategy that aligns with their risk tolerance and personality, allowing them to achieve the best returns while still enjoying peace of mind?

In the following sections, we’ll explore each strategy in detail, analyzing their strengths and weaknesses to help you make an informed choice.