Table of Contents

- 0.1 What Is Interactive Brokers (IB)? How Can You Open an Account?

- 0.2 What Is Interactive Brokers?

- 0.3 What Is Interactive Brokers Used For?

- 0.4 Interactive Brokers Sign-Up Bonus — Earn Up to $1,000!

- 0.5 How to Claim the IBKR Sign-Up Bonus (2026 Update)

- 0.6 Important Notes

- 0.7 Don’t Register from the Main IBKR Homepage!

- 0.8 Sunfortzone’s Experience & Eligibility

- 0.9 Interactive Brokers Account Requirements: A Beginner’s Guide

- 0.10 Who Can Open an Interactive Brokers (IBKR) Account?

- 0.11 Is Interactive Brokers Available in My Country?

- 0.12 Account Opening Requirements for Interactive Brokers

- 0.13 Step-by-Step Tutorial: How to Open an Interactive Brokers Account

- 0.14 Step 1: Required Information and Eligibility

- 0.15 Step 2: Claim Your IBKR Sign-Up Bonus

- 0.16 Step 3: Create Your IBKR Account

- 0.17 Step 4: Choose Your Account Type

- 0.18 Choose Your Service Plan (U.S. Residents Only)

- 0.19 Step 5: Enter Your Personal Information

- 0.20 Step 6: Select Account Type & Trading Products

- 0.21 Stock Yield Enhancement Program (SYEP)

- 0.22 Financial Profile & Trading Authorization

- 0.23 Step 7: Confirm Your Tax Residency

- 0.24 Step 8: Sign the Trading Agreement

- 0.25 Step 9: Verify Identity and Address

- 0.26 Step 10: Receive Account Approval

- 1 Related Articles

What Is Interactive Brokers (IB)? How Can You Open an Account?

If you’re planning to start investing in stocks but don’t know where to begin, this guide will walk you through the process step by step.

In this article, I’ll provide a detailed, visual tutorial on how to open an account with one of the world’s leading online brokerage platforms — Interactive Brokers (IBKR).

If you’re looking for safe, low-cost access to global stocks and bonds, you won’t want to miss this.

What Is Interactive Brokers?

Interactive Brokers (IBKR), listed on the NASDAQ Stock Exchange (ticker: IBKR), is a global brokerage firm regulated by the U.S. Securities and Exchange Commission (SEC).

Often referred to as IB or IBKR, it operates the largest electronic trading platform in the U.S. based on daily average revenue trades. Recognized by Forbes as one of the best online brokers, IBKR offers some of the lowest fees in the industry — making it a top choice among cost-conscious investors.

When it comes to pricing, Interactive Brokers stands out for having no custodian fees and no minimum deposit for standard cash accounts — making it accessible and affordable for beginners and professionals alike.

What Is Interactive Brokers Used For?

Through IBKR, investors can trade in over 200 countries and regions, covering 150 markets and 27 currencies. Many users praise IBKR for its low fees and extensive access to global exchanges.

With a simple online account setup, investors can explore a wide variety of investment options in a secure, trusted trading environment.

Interactive Brokers Sign-Up Bonus — Earn Up to $1,000!

Good news! Interactive Brokers currently offers a Refer-a-Friend Sign-Up Bonus, allowing new users to earn up to $1,000 in IBKR stock.

Here’s how it works:

- Register using a valid referral link.

- Open your account and make a deposit.

- Earn 0.3% back in IBKR stock (up to $1,000).

- Hold your bonus shares for one year before they become withdrawable.

This is an excellent reward for long-term investors who plan to grow their portfolios.

How to Claim the IBKR Sign-Up Bonus (2026 Update)

You can always check the official terms, but here’s a quick overview:

Step 1: Sign up with a valid referral link

The referral must come from a user with at least $2,000 US dollars in assets and have executed at least one securities transaction.

Step 2: Open and fund your account

You can deposit funds via wire transfer, securities transfer, or asset transfer.

All net deposits (deposits minus withdrawals) made within one year count toward the bonus.

Step 3: Earn 1% back in IBKR stock

For every $300 you deposit, you’ll receive $1 in IBKR shares.

The stock value updates automatically based on your balance.

Bonus shares must remain in your account for 12 months before withdrawal.

The maximum reward is $1,000, equivalent to a $300,000 deposit.

Important Notes

- Withdrawals matter: Any withdrawal during the year reduces your eligible bonus.

- Use a valid referral link: Accounts without one don’t qualify.

- Same household restriction: Referrer and referee cannot share the same address.

In summary:

Open your account → Fund it → Earn IBKR stock automatically → Unlock after 1 year

⚠️ The bonus value isn’t guaranteed. The stock price may fluctuate, but it’s still a great incentive for long-term investors.

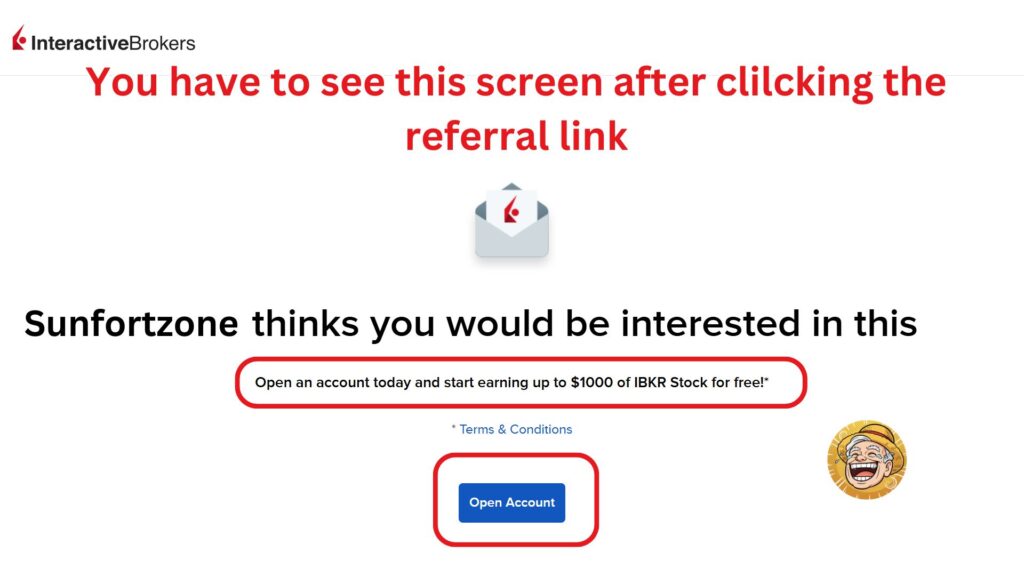

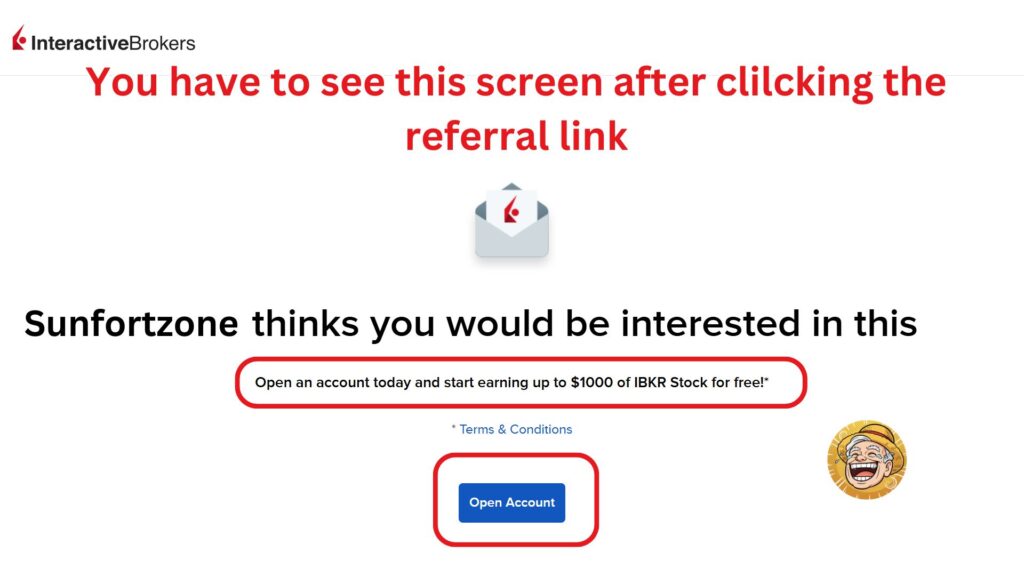

Don’t Register from the Main IBKR Homepage!

If you sign up directly on the IBKR website without a referral link, you won’t be eligible for the sign-up bonus. Always confirm that you see the message:

“You are signing up with a referral code.”

Sunfortzone’s Experience & Eligibility

Note: Residents of certain countries — including Spain, Portugal, Japan, Denmark, and Israel — are not eligible for the program.

For details, review the official Interactive Brokers “Refer-A-Friend” program terms and conditions.

Interactive Brokers Account Requirements: A Beginner’s Guide

In this beginner’s guide, I’ll explain the key requirements and steps to open an Interactive Brokers account — helping you start your investment journey quickly and confidently.

Who Can Open an Interactive Brokers (IBKR) Account?

Interactive Brokers offers four main types of accounts for applicants:

- Individual Investor or Trader

- Family Office

- Non-Professional Advisor

- Small Business

For most retail investors, the Individual account is the most suitable option.

Is Interactive Brokers Available in My Country?

Before you start your registration, it’s important to check whether IBKR is available in your country.

In addition to the United States, Interactive Brokers operates in many other countries worldwide.

You can verify availability by visiting the official Interactive Brokers “Available Countries and Territories” page.

Account Opening Requirements for Interactive Brokers

The documents required vary slightly depending on the account type and the applicant’s country of residence.

However, all applicants must provide the following:

- A valid email address

- A personal mobile phone number

- Proof of address (such as a utility bill or bank statement)

- Proof of identity (such as a passport or ID card)

Additional requirements:

- U.S. residents must also provide:

- Social Security Number (SSN) or another government-issued ID number

- Employer’s name, address, and phone number

- Linked bank or third-party brokerage account number

- Non-U.S. residents must provide:

- A valid passport or national ID card

For a full list of country-specific document requirements, visit IBKR’s “What You Need for the Application” page.

Step-by-Step Tutorial: How to Open an Interactive Brokers Account

Below is a complete walkthrough of the account opening process. For non-U.S. residents, there are two additional steps — confirming tax residency and verifying identity and address.

- Step 1: Confirm pre-account information

- Step 2: Claim your IBKR referral bonus

- Step 3: Create your Interactive Brokers account

- Step 4: Choose your account type

- Step 5: Fill in personal information

- Step 6: Select trading account type and products

- Step 7: Confirm tax residence (non-U.S. residents only)

- Step 8: Review and sign agreements

- Step 9: Verify identity and address (non-U.S. residents only)

- Step 10: Receive account approval notification

Step 1: Required Information and Eligibility

Previously, Interactive Brokers required a minimum deposit of USD 10,000. Since July 2021, that requirement and all monthly custodian fees have been removed.

Minimum Age Requirements:

- Margin Account: 21 years old or above

- Cash Account: 18 years old or above

- IRA Account: Available to individual U.S. citizens or U.S. resident aliens only

| Account Type | Description |

|---|---|

| Margin Account | Allows leveraged trading using borrowed funds; involves higher risk and interest costs. |

| Cash Account | Permits trading only with settled cash; lower risk. |

| IRA Account | A tax-advantaged retirement account; margin trading not permitted. |

💡 Sunfortzone’s Tip:

If you’re new to investing and unfamiliar with margin trading, start with a Cash Account. Avoid trading with borrowed money unless you fully understand the risks.

Step 2: Claim Your IBKR Sign-Up Bonus

Use a valid referral link to ensure you’re eligible for the bonus.

Once you register and fund your account, you can earn up to $1,000 in free IBKR stock as part of the referral program.

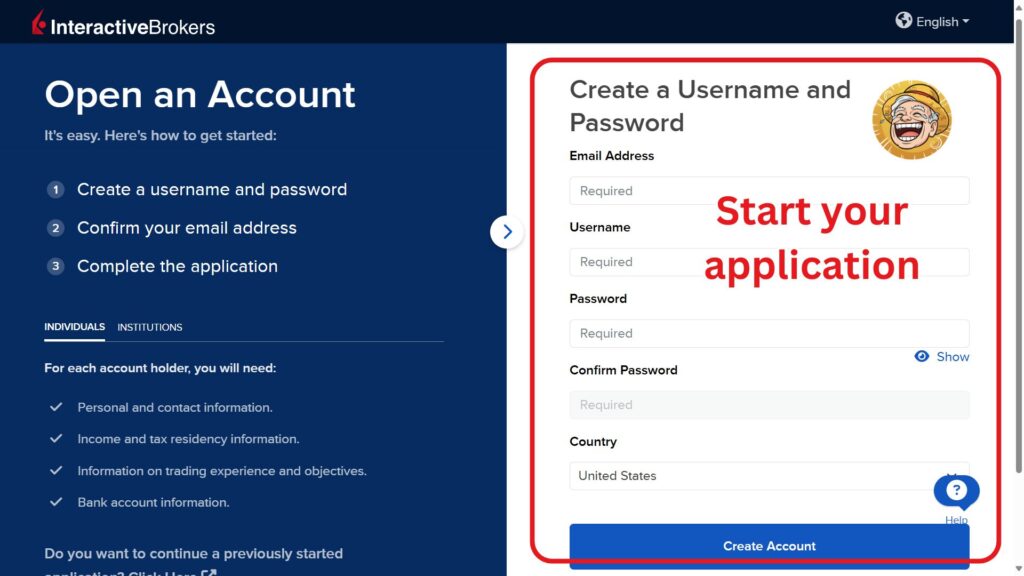

Step 3: Create Your IBKR Account

After signing up, you can manage multiple accounts or sub-accounts under one main login.

Steps to create your account:

- Create a username and password.

- If you encounter an issue during setup, simply log in again on the IB website to continue from where you left off.

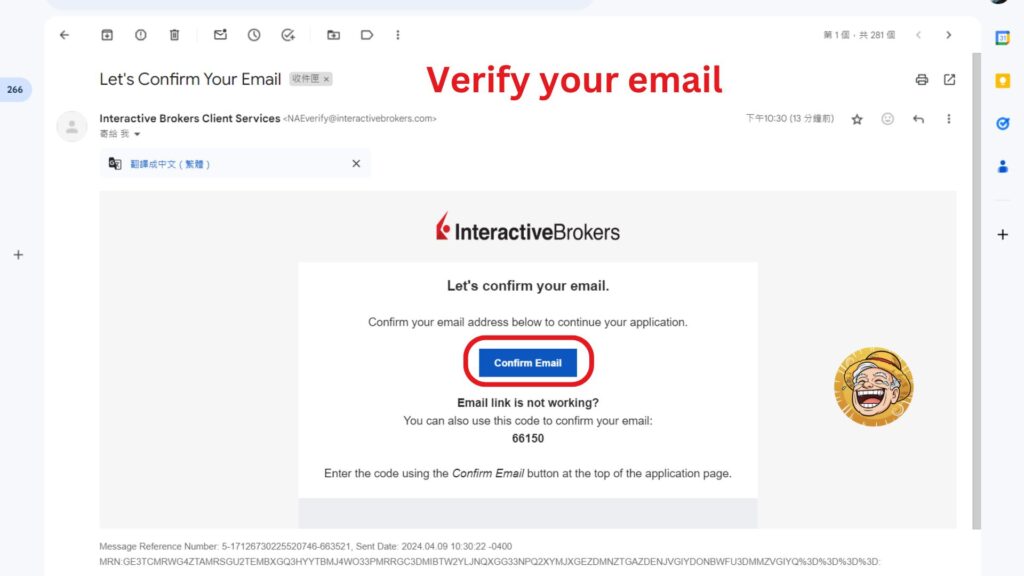

- Verify your email.

- Check your inbox for an email from Interactive Brokers Client Services.

- Click “Confirm Email” to proceed.

- If you don’t see it, look in your “All Mail” or Spam folders.

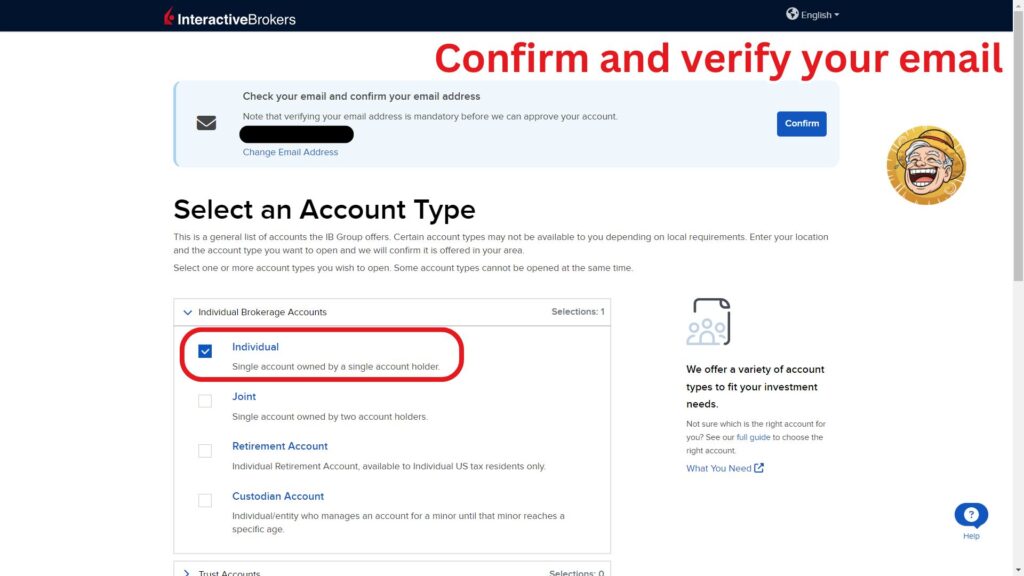

Step 4: Choose Your Account Type

After verification, you’ll select one of the following four account types:

- Individual Account

- Joint Account

- Retirement Account

- Custodian Account

1. Individual Account

An Individual Account is owned and managed by a single person. It’s the most common type for personal investing, allowing you to trade stocks, ETFs, options, bonds, and more under your own name.

2. Joint Account

A Joint Account is shared by two people—often spouses or family members—who both have ownership and access to the funds. Profits, losses, and responsibilities are shared between the account holders.

3. Retirement Account (IRA)

A Retirement Account (IRA) is available to U.S. citizens and resident aliens. It provides tax advantages for long-term retirement savings but comes with contribution limits and restrictions on early withdrawals.

4. Custodian Account

A Custodian Account is opened by an adult (the custodian) on behalf of a minor. The custodian manages the investments until the child reaches the legal age to take control of the account.

For this tutorial, we’ll focus on the Individual Account setup.

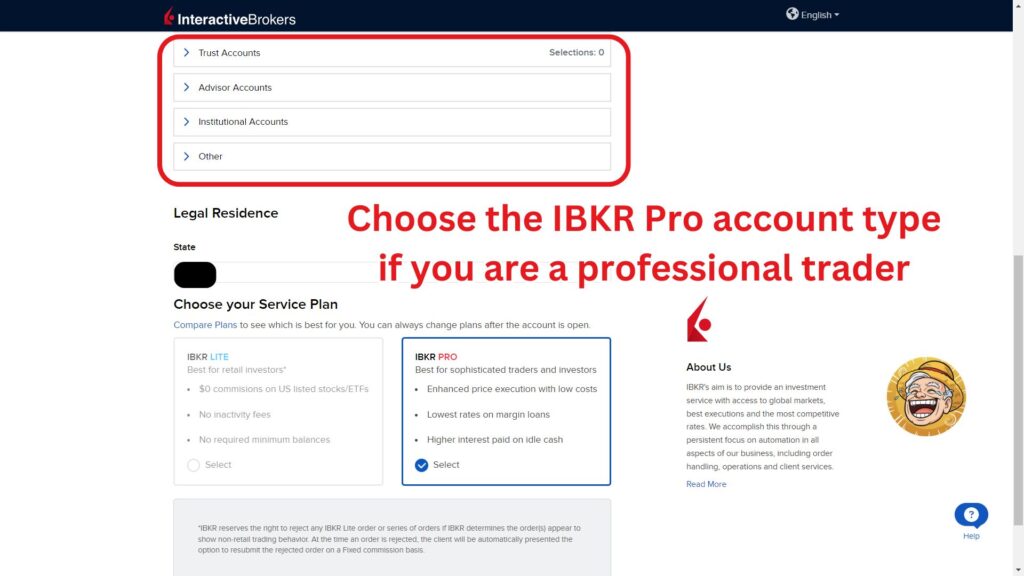

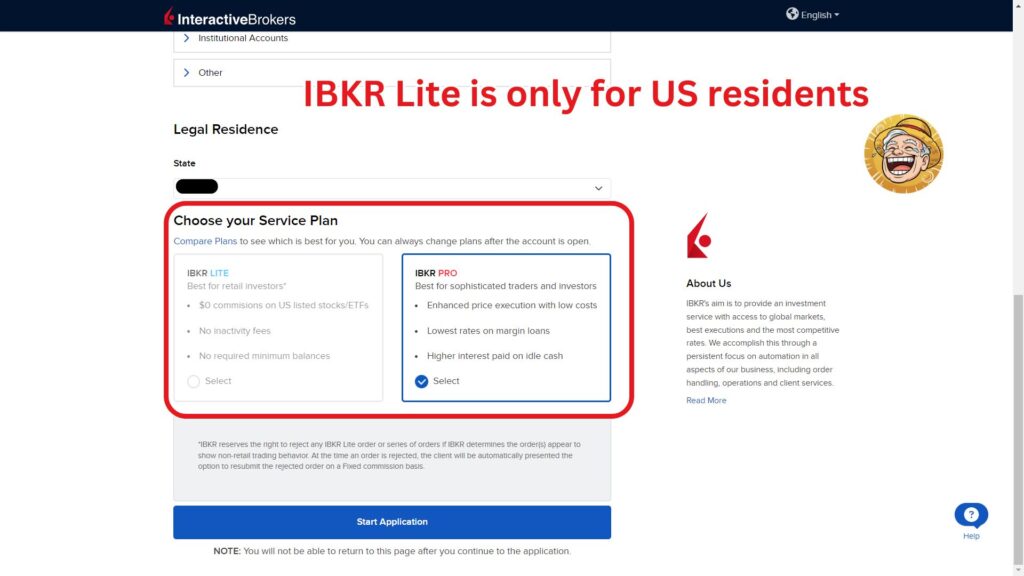

Choose Your Service Plan (U.S. Residents Only)

If you’re located in the United States, you can choose between two service plans — IBKR Lite and IBKR Pro:

| Feature | IBKR Lite | IBKR Pro |

|---|---|---|

| Availability | U.S. residents only | All users |

| U.S. Stock Commissions | Free | Tiered or Fixed pricing |

| Real-Time Quotes | Free for U.S. markets | Subscription needed for some markets |

| Margin Interest Rate | Benchmark + 2.5% | Benchmark + 1.5% (lower with higher balances) |

| Interest on Idle Cash | Benchmark – 1.5% | Benchmark – 0.5% |

| Trading Hours (U.S. Time) | 07:00–20:00 | 04:00–20:00 |

Notes:

- IBKR Lite: Offers commission-free trading on U.S.-listed stocks and ETFs.

- IBKR Pro: Provides two pricing options — Fixed Rate (up to $0.005 per share) or Tiered Pricing, depending on trading volume. To help save the most out of your trading costs, go to our content about the detailed comparison between IB’s fixed pricing vs tiered pricing.

- Non-U.S. residents can only use IBKR Pro, so the IBKR Lite option will not appear during account setup.

Why IBKR Pro offers better margin interest rates and higher interest on idle cash compared to IBKR Lite ?

💰 1. IBKR Pro Targets Active or Professional Traders

IBKR Pro is designed for more experienced investors and active traders who typically hold larger account balances and higher trading volumes.

To attract and retain these clients, Interactive Brokers offers more favorable financial terms, such as:

- Lower borrowing costs (margin interest)

- Higher returns on uninvested cash balances

📉 2. Lower Margin Interest = Incentive for High-Volume Traders

When you trade on margin, you’re borrowing money from IBKR to increase your buying power.

IBKR Pro clients are often more sophisticated traders who borrow larger amounts, so IBKR can offer a lower interest rate spread (e.g., +1.5%) while still earning a profit from the volume.

In contrast, IBKR Lite clients trade less frequently, so their margin rates are set higher (e.g., +2.5%) to offset smaller loan volumes.

💵 3. Higher Interest on Idle Cash = Reward for Bigger Balances

Idle cash is the uninvested money sitting in your account.

IBKR Pro pays more interest (Benchmark – 0.5%) because:

- Pro accounts generally hold larger idle cash balances, giving IBKR more funds to reinvest.

- Paying better interest helps keep those large, professional clients on the platform.

Meanwhile, IBKR Lite accounts cater to casual or beginner investors who usually hold smaller cash balances, so the interest paid is lower (Benchmark – 1.5%).

Finally, choose “English” as your preferred input language.

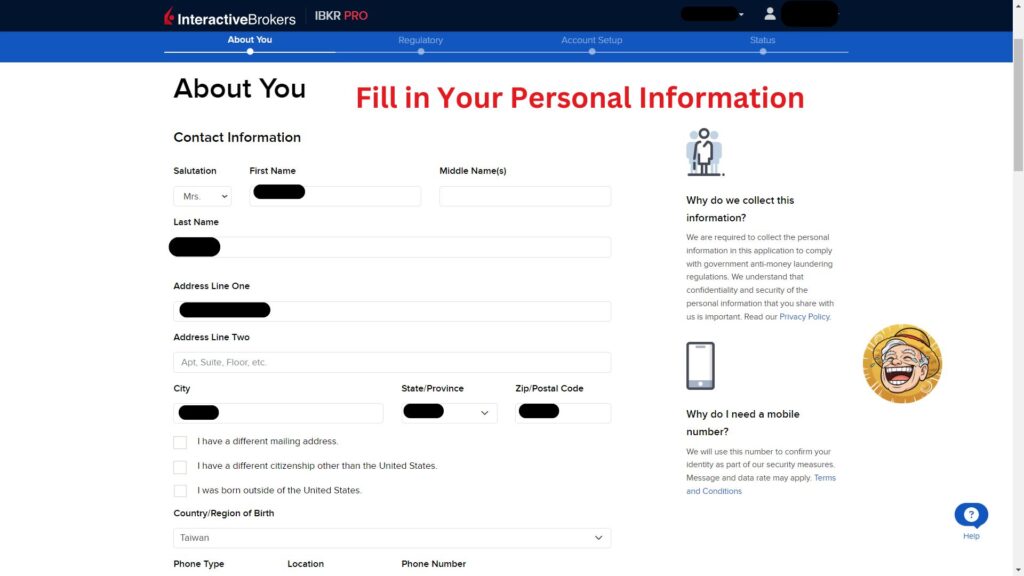

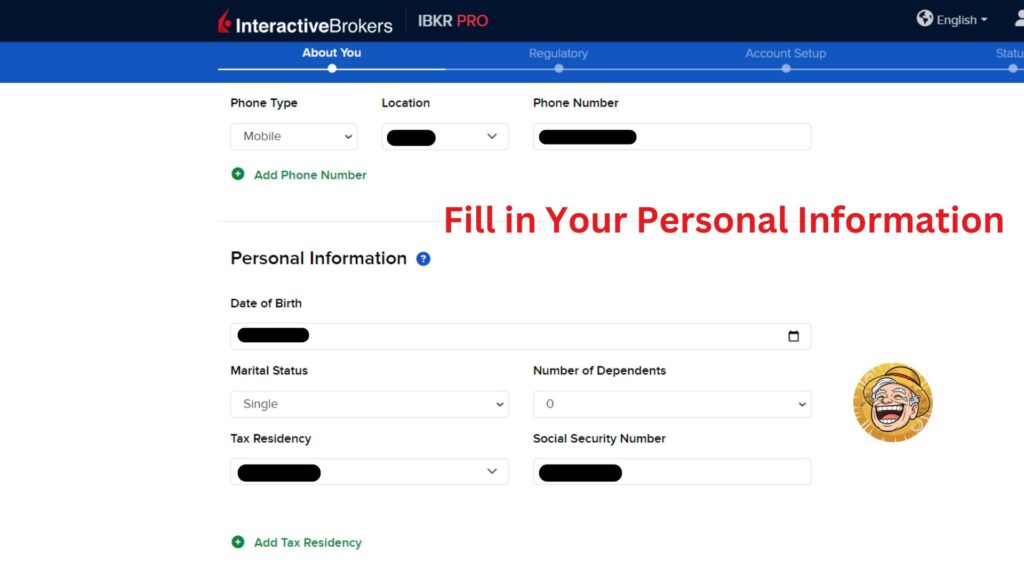

Step 5: Enter Your Personal Information

Provide Contact Details

Enter the account holder’s own contact information. You cannot use another person’s bank account for deposits or withdrawals — all transactions must be made under your own name.

Make sure your name matches the one on your identification document (use your English name).

If your mailing address differs from your residential address, you can add it separately.

For those with dual citizenship or who were born outside the United States, select the relevant options and complete the required fields based on your personal situation.

Enter Personal and Tax Information

Next, fill in your personal details and specify your tax residency.

- U.S. residents: Enter your Social Security Number (SSN).

- Non-U.S. residents: Enter your Tax Identification Number (TIN) and make sure it matches your proof of identity.

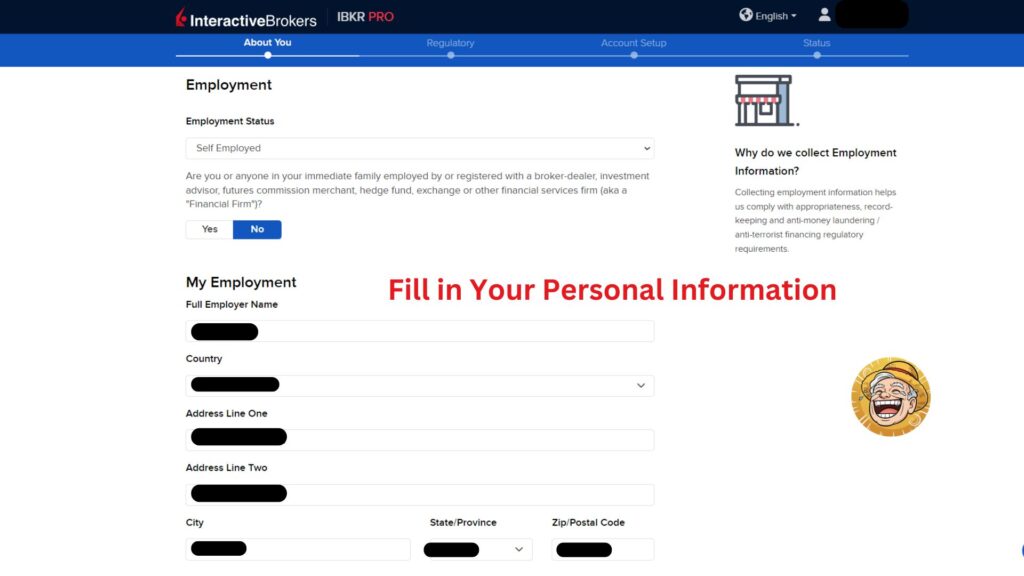

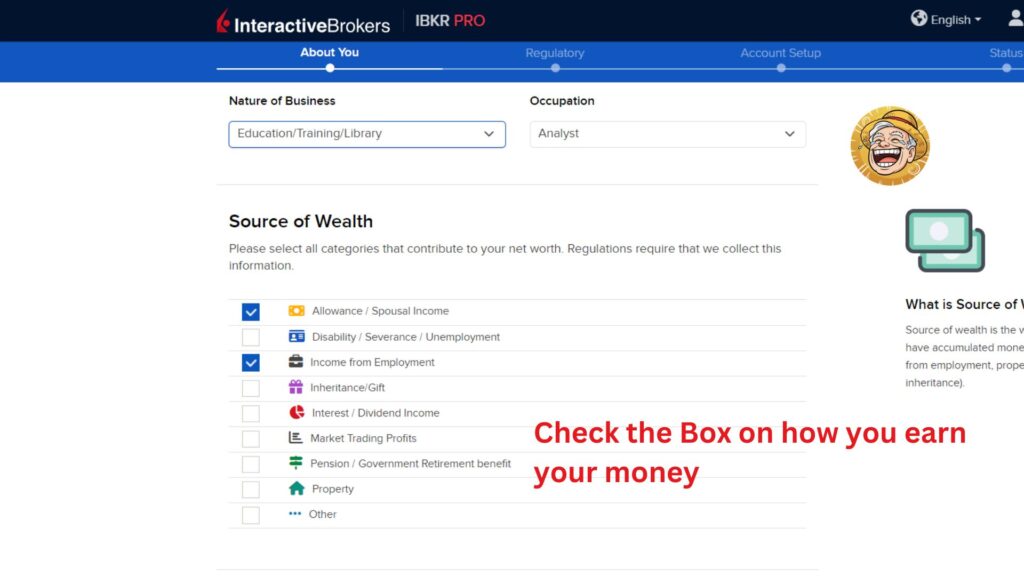

Employment and Financial Information

You’ll be asked to confirm your employment status and whether you’re a financial professional (most users should select “No”).

Provide your source of wealth honestly — for most individuals, this will be “Income from Employment.”

Listing multiple income sources helps demonstrate financial stability.

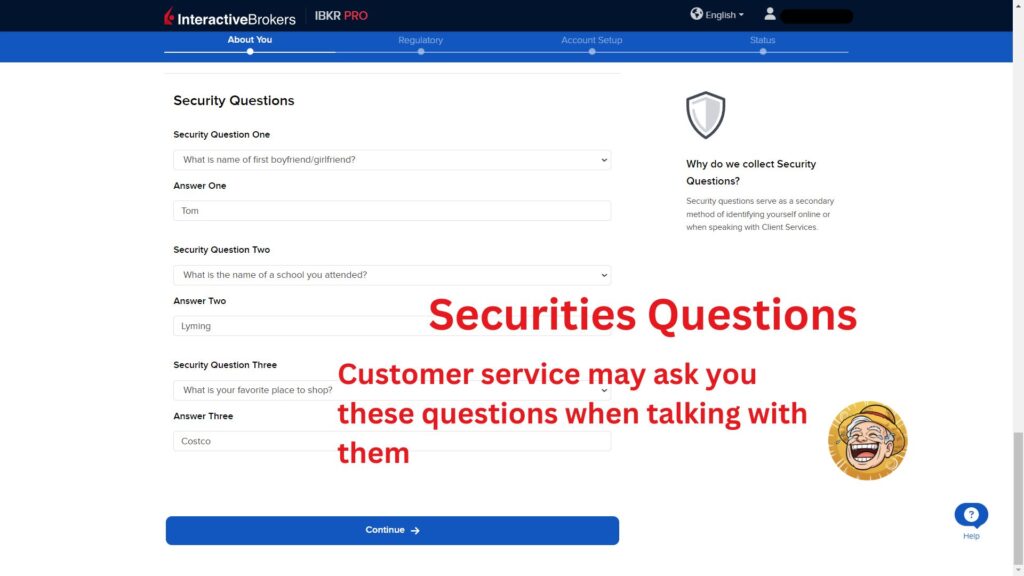

Security Questions

You’ll be prompted to set up three security questions used for identity verification when contacting customer service.

💡 Tip: To make them easier to remember, you can use the same answer for all three questions.

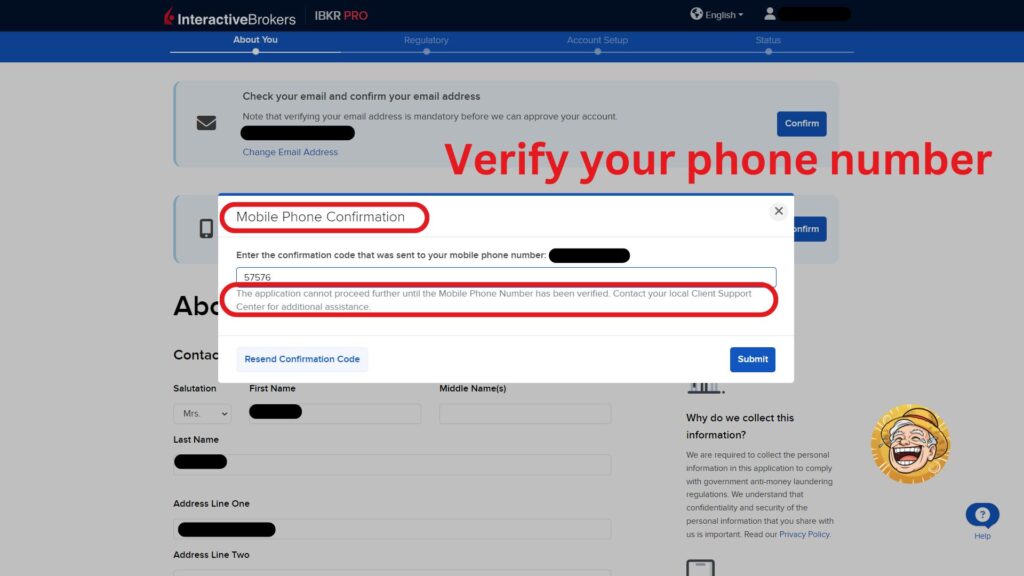

Verify Your Mobile Number

A verification code will be sent via SMS to the mobile number you entered. Enter the code in the system to confirm your phone number.

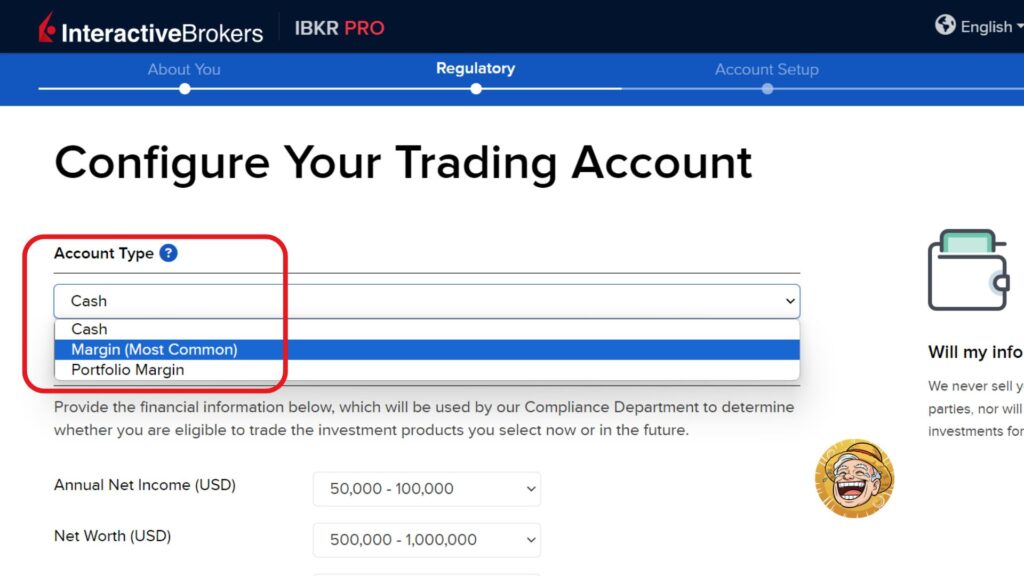

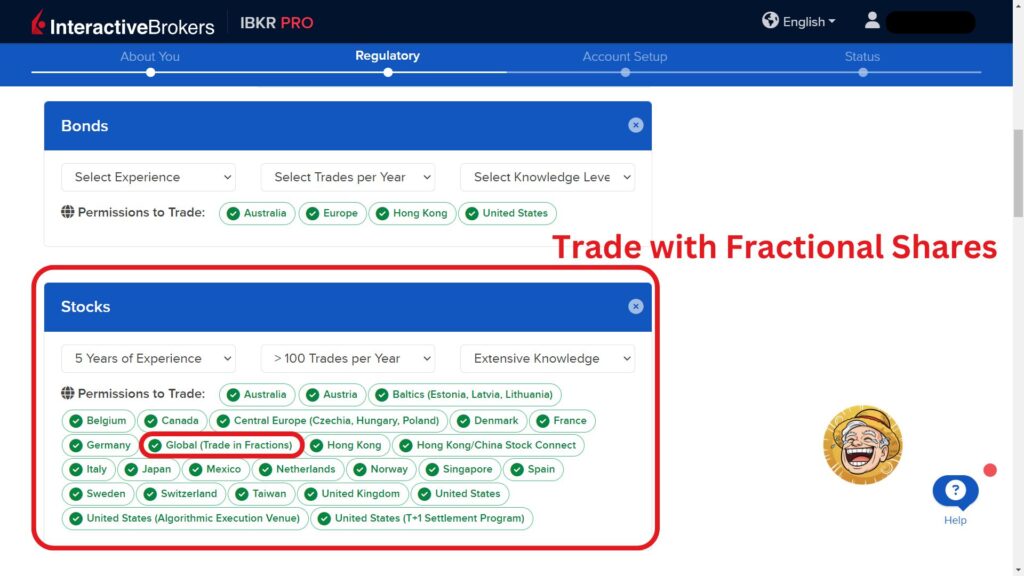

Step 6: Select Account Type & Trading Products

Choose Account Type

| Account Type | Description |

|---|---|

| Cash Account | Trades only with settled cash. No borrowing or leverage. |

| Margin Account | Allows borrowing funds to increase buying power (higher risk). |

Comparing the two main account types offered by Interactive Brokers, a Cash Account allows you to trade only with the money you’ve deposited, meaning no borrowing or leverage is involved—ideal for conservative investors or beginners. In contrast, a Margin Account lets you borrow funds from IBKR to increase your buying power, offering greater potential returns but also higher risk.

💡 Tip: If you’re new to investing or unfamiliar with margin trading, it’s safer to start with a Cash Account.

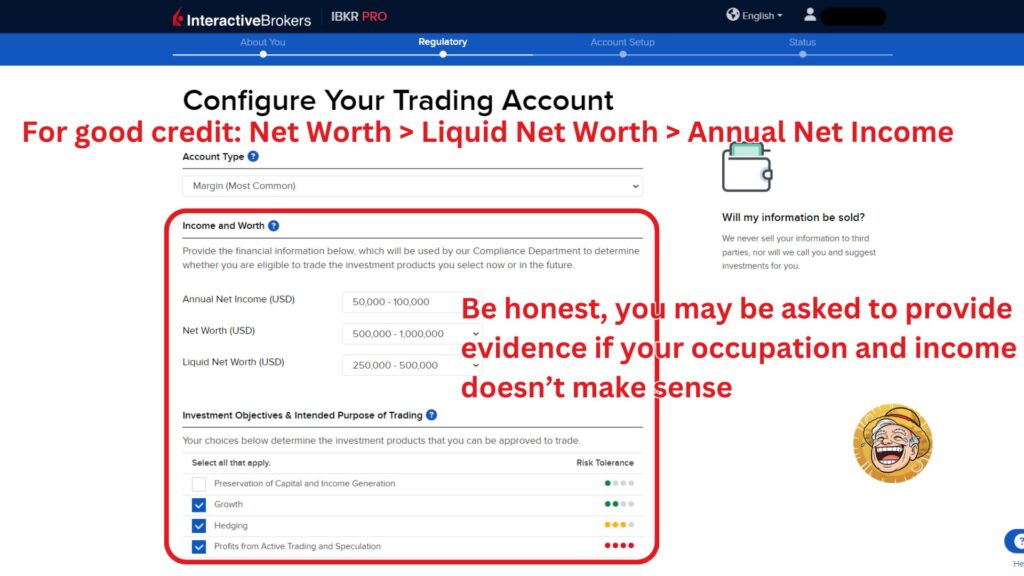

Enter Financial Details

| Field | Description |

|---|---|

| Net Worth | Total assets minus liabilities. Should be higher than Liquid Net Worth. |

| Liquid Net Worth | Readily available funds; should exceed Annual Net Income. |

| Annual Net Income | Your total yearly income, showing financial stability. |

When opening a new IBKR account, you’ll need to enter three key financial figures: Annual Net Income, Liquid Net Worth, and Total Net Worth. Your Annual Net Income represents your total yearly earnings. Liquid Net Worth includes the portion of your assets that can be quickly converted to cash, such as savings or investments. Total Net Worth is the value of all your assets minus your liabilities. A good rule of thumb is to make sure these values follow this logical order: Net Worth > Liquid Net Worth > Annual Net Income, which shows consistent saving habits and a solid ability to handle investment risks.

Select Markets and Products to Trade

Choose the markets (U.S., Europe, Asia, etc.) and product types you want to trade — such as stocks, options, crypto, or forex.

Your access depends on your trading experience; selecting “Good Knowledge” allows broader product access.

You can always add more products later after your account is open.

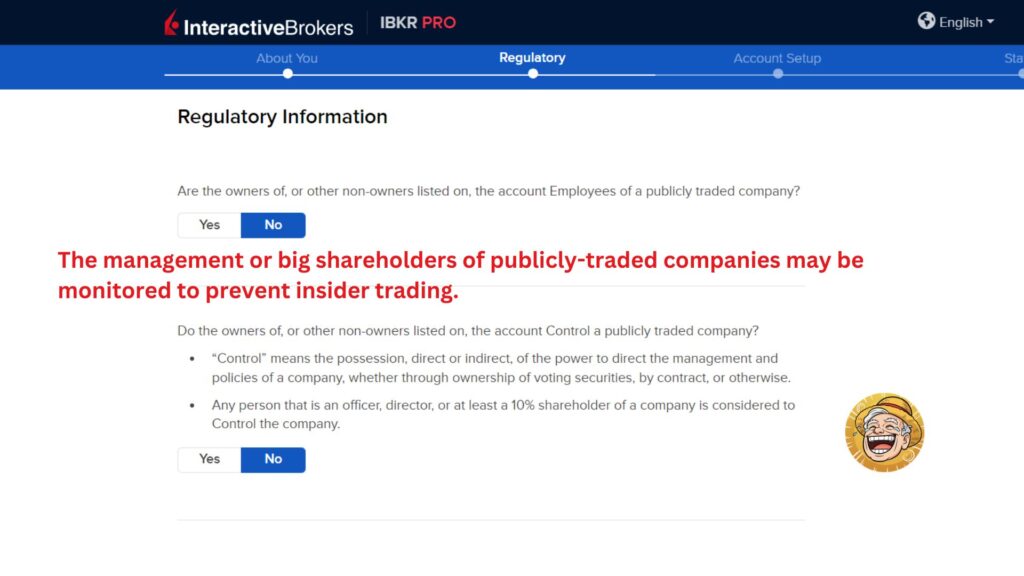

Regulatory Information

Confirm that you are not a major shareholder or insider of any U.S.-listed company to comply with insider trading regulations.

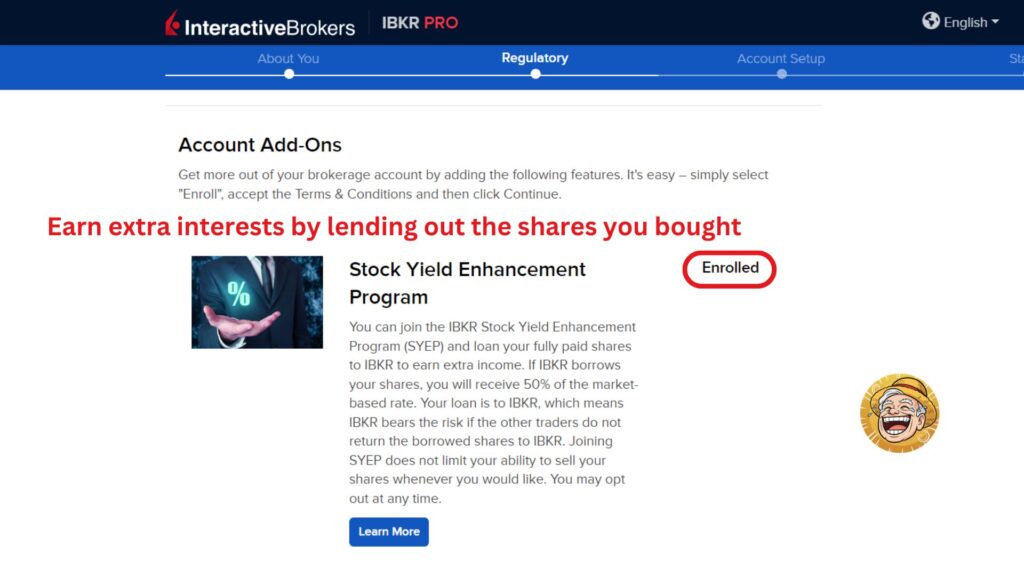

Stock Yield Enhancement Program (SYEP)

What it is:

This program allows you to lend your fully paid shares to other traders through IBKR and earn 50% of the market-based interest rate on borrowed shares.

Pros:

- Earn extra income by lending your stocks.

- You can still sell the stocks anytime.

Cons:

| Drawback | Description |

|---|---|

| Loss of Voting Rights | You temporarily lose shareholder voting rights for lent shares. |

| No SIPC Protection | Lent securities are not covered under SIPC’s $500,000 protection, as SIPC doesn’t insure investment risks. |

The main drawbacks of participating in IBKR’s Stock Yield Enhancement Program (SYEP) is that when you lend your shares through SYEP, you temporarily lose your shareholder voting rights for those lent stocks. In addition, the lent securities are not protected by SIPC’s $500,000 insurance, since SIPC coverage does not apply to investment risks.

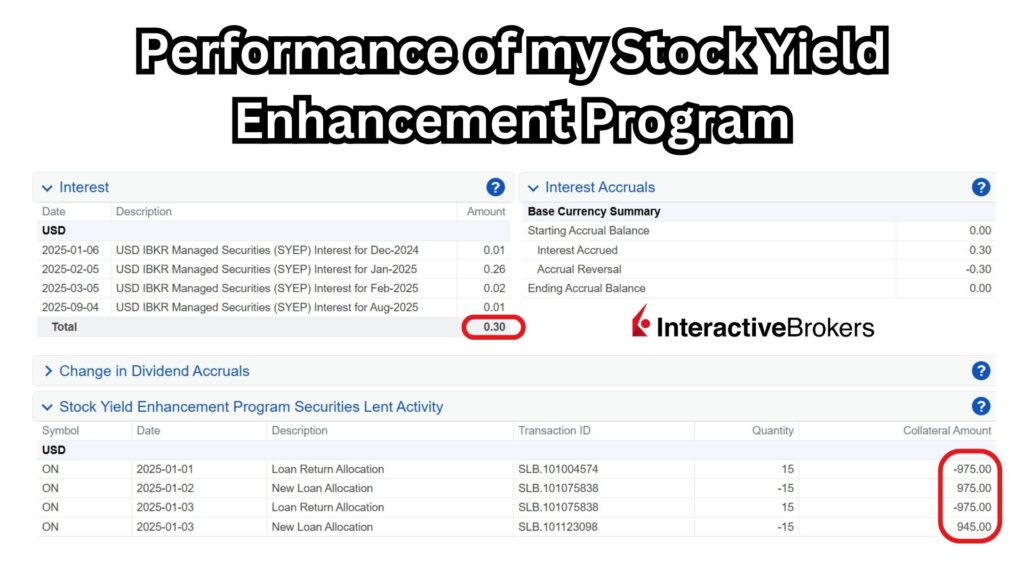

Sunfortzone’s peresonal experience

I myself do enroll in the Stock Yield Enhancement Program to earn some interests. However, the interest eared is so low like only 0.03% compared to my portfolio value in a given year. In reality, I have around 900 US dollars worth of On semiconductor stock, ticker symbol ON, and the interest earned in 2025 by lending out my shares is only 0.3 US dollars! So, just to let you know that not all your shares will have the opportunity to be borrowed. I depends on the supply and demand of the market participants.

Financial Profile & Trading Authorization

Before finalizing, IBKR will review whether your income, net worth, and experience match your selected trading permissions (e.g., options trading).

If your financial profile doesn’t align, you may be asked to complete a short knowledge test. To help you pass the quiz, in this content, we got you the screenshots for all the questions and answers.

In some cases, IBKR may request proof of income if your stated numbers appear inconsistent with your job type.

💡 Tip: To gain approval for options trading, ensure your financial values are realistic and consistent.

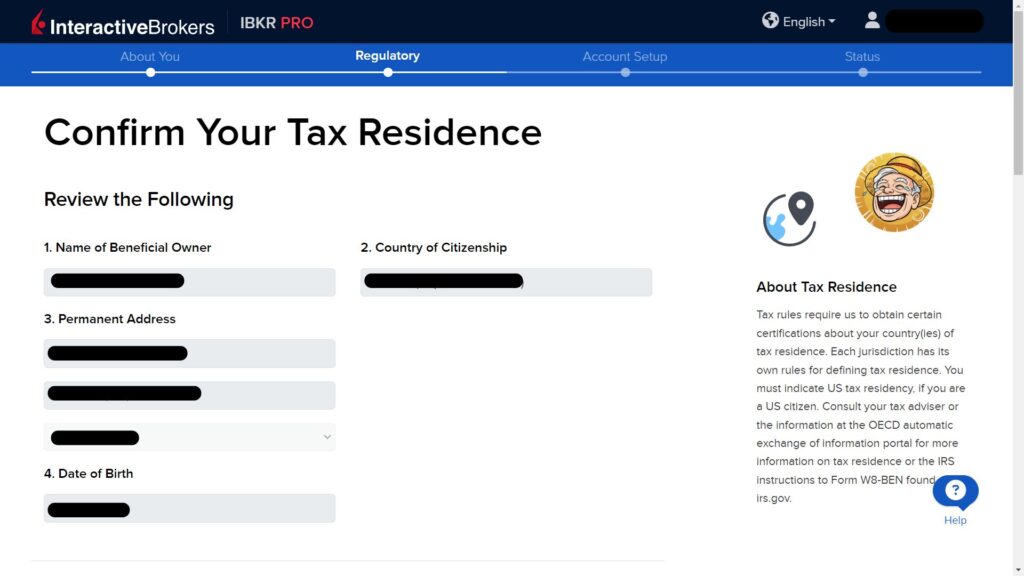

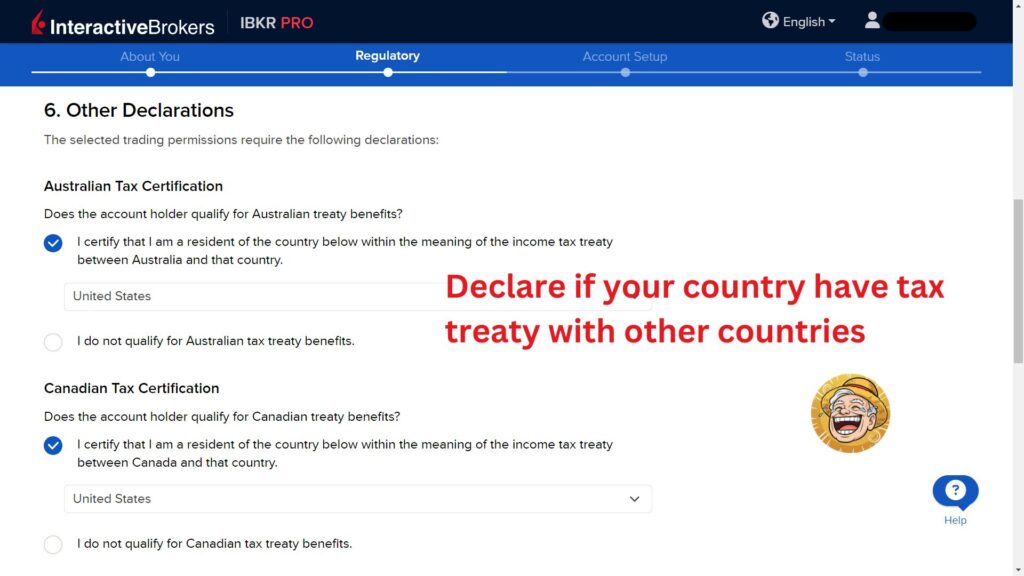

Step 7: Confirm Your Tax Residency

If you are not a U.S. resident, you’ll need to confirm your tax residency as part of the account opening process. This step replaces submitting Form W-8BEN, which serves to certify that you are a non-U.S. person and therefore not subject to U.S. tax obligations or eligible for U.S. tax treaty benefits.

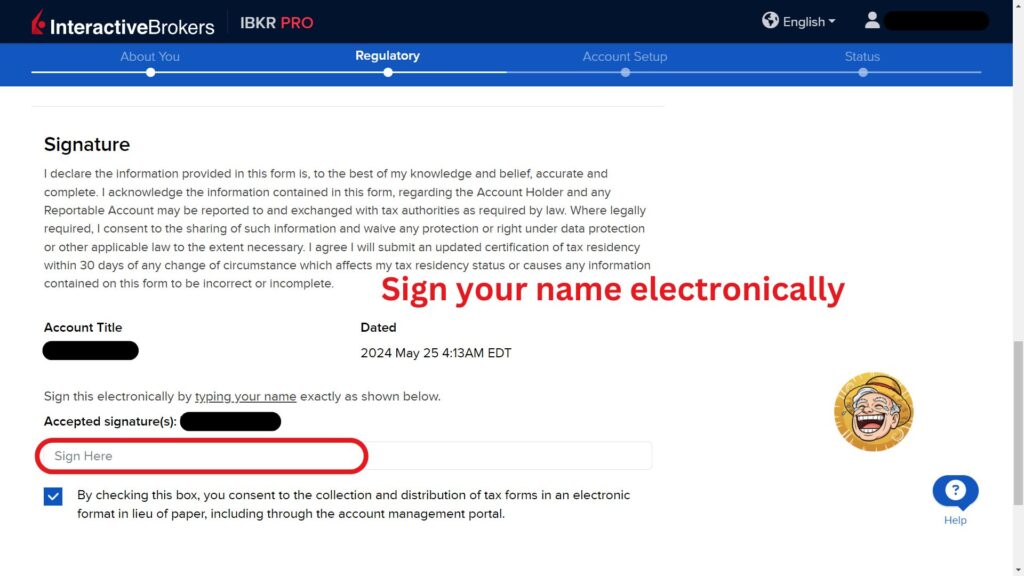

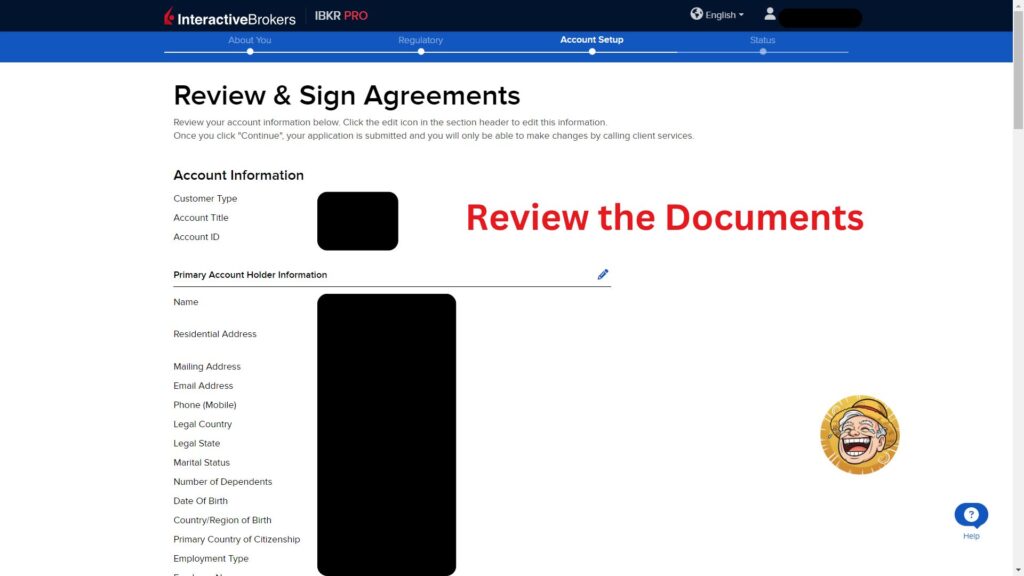

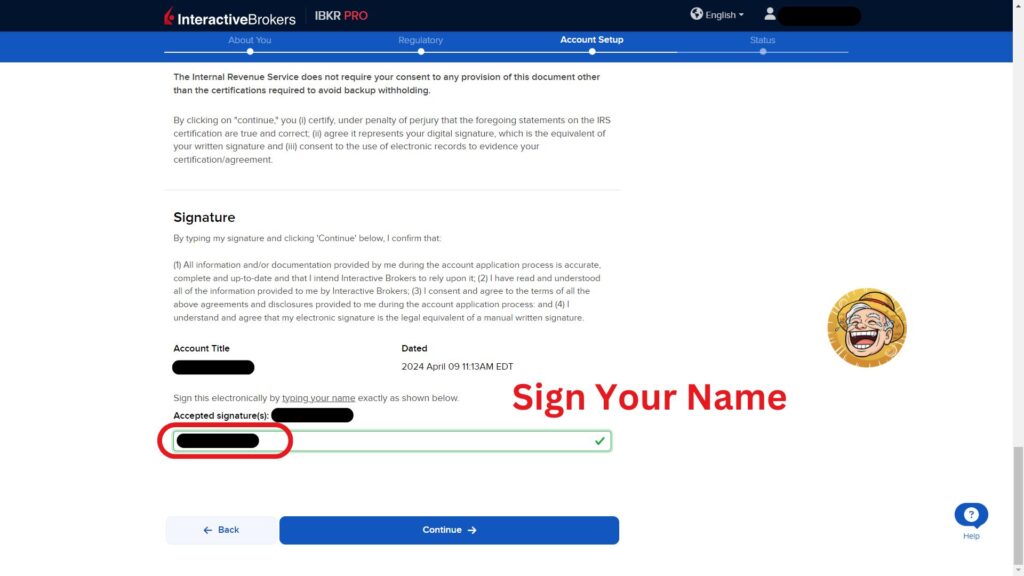

Step 8: Sign the Trading Agreement

Next, you’ll need to review and sign the trading agreement. If you selected the option to trade cryptocurrencies, you must also complete the IB Cryptocurrency Application Form, which outlines the risks involved in digital asset trading. Cryptocurrency transactions on Interactive Brokers are executed and custodied by Paxos Trust Company, which currently supports major coins like Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), and Litecoin (LTC). If you didn’t apply for crypto trading, you can skip this part and go directly to the Read & Sign Agreements section to review and confirm all your information.

Step 9: Verify Identity and Address

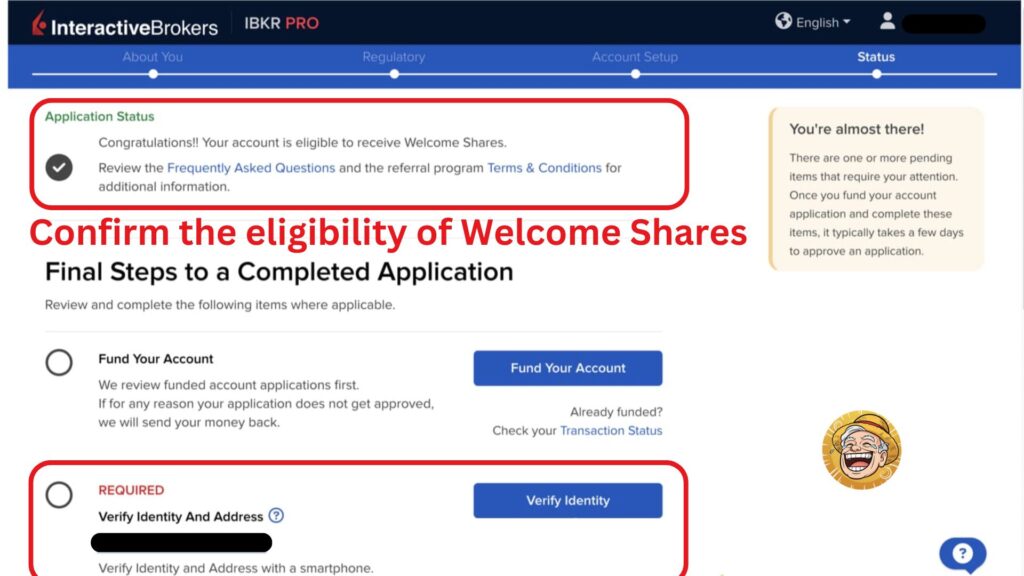

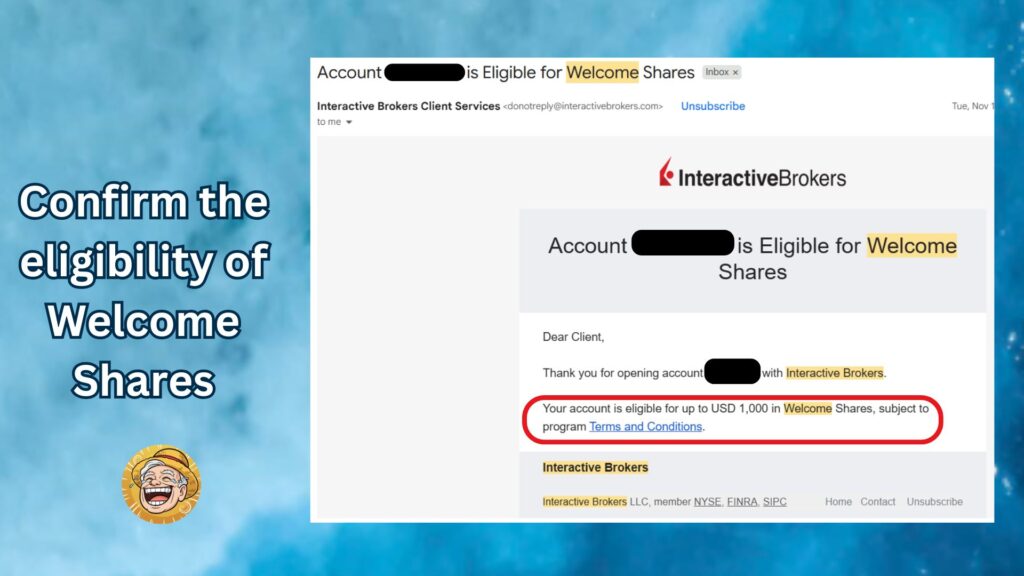

For U.S. residents, once your application is complete, you’ll see a confirmation page and can check your email to see if you’re eligible for the Welcome Shares referral bonus (up to $1,000).

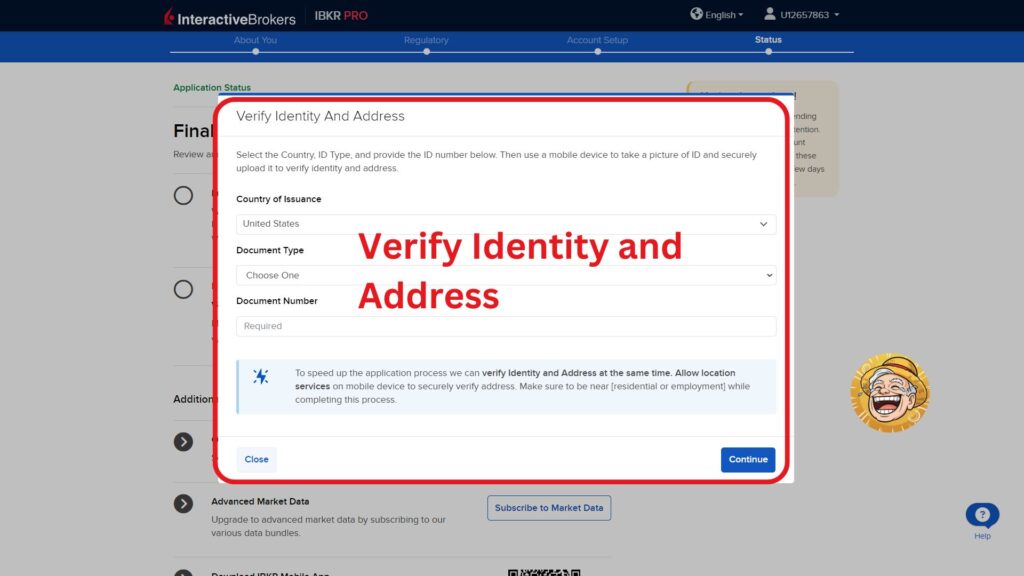

For non-U.S. residents, you’ll need to complete the final verification step — identity and address verification. It’s recommended to use your National ID Card. If you choose to use your passport, upload the full photo page with all corners visible to ensure quick approval. Make sure all documents are valid and not expired.

Step 10: Receive Account Approval

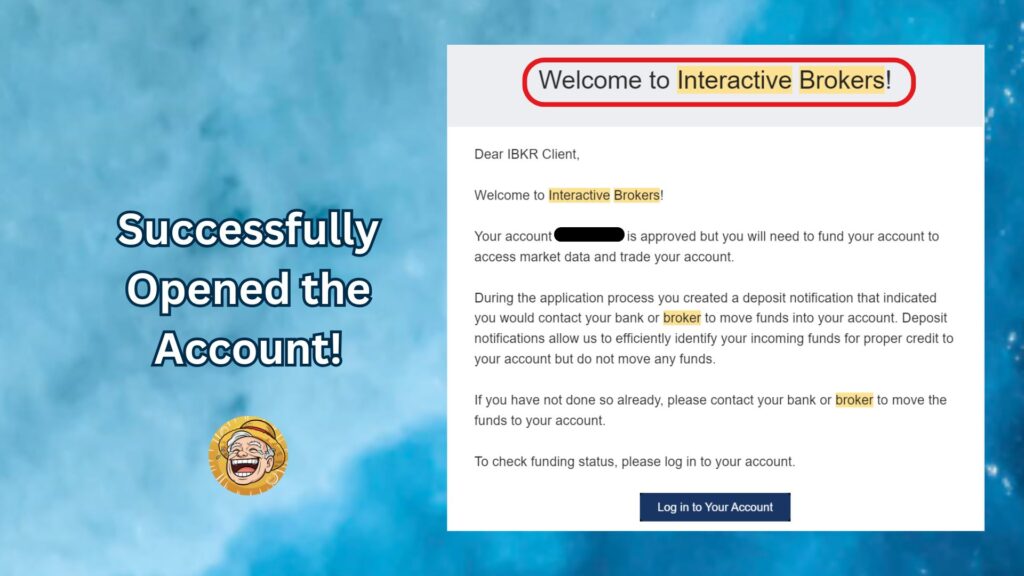

Congratulations! Once these steps are completed, your IBKR account will usually be approved and activated immediately or in a few days, allowing you to start trading right away.

If you want to speed up the account review process, we recommend making a deposit notice, because Interactive Brokers review customers who have the intent to deposit first!

In addition, our Sunfortzone community has created a discussion group for Interactive Brokers (IBKR).

In this group, everyone shares how to use this U.S. brokerage to buy global stocks, such as European stocks like LVMH and U.S. stocks.

We also share tips on how to deposit and withdraw funds, as well as how to place trades.

So, if you’re interested in this brokerage, you’re welcome to join our discussion group first.

Wish you success in your investing journey!